buyNow

Carbon Farming Market

Carbon Farming Market Size, Share, Growth & Industry Analysis, By Component (Product, Services), By Application (Agriculture, Forestry), and Regional Analysis, 2025-2032

pages: 150 | baseYear: 2024 | release: July 2025 | author: Versha V.

Market Definition

Carbon farming involves the implementation of agricultural practices that enhance carbon sequestration in soil and vegetation. These practices include cover cropping, reduced tillage, agroforestry, and improved grazing management.

The market encompasses a range of stakeholders such as farmers, carbon credit buyers, technology providers, and verification agencies. It plays a vital role in climate mitigation strategies across agriculture, forestry, and land use sectors.

Carbon Farming Market Overview

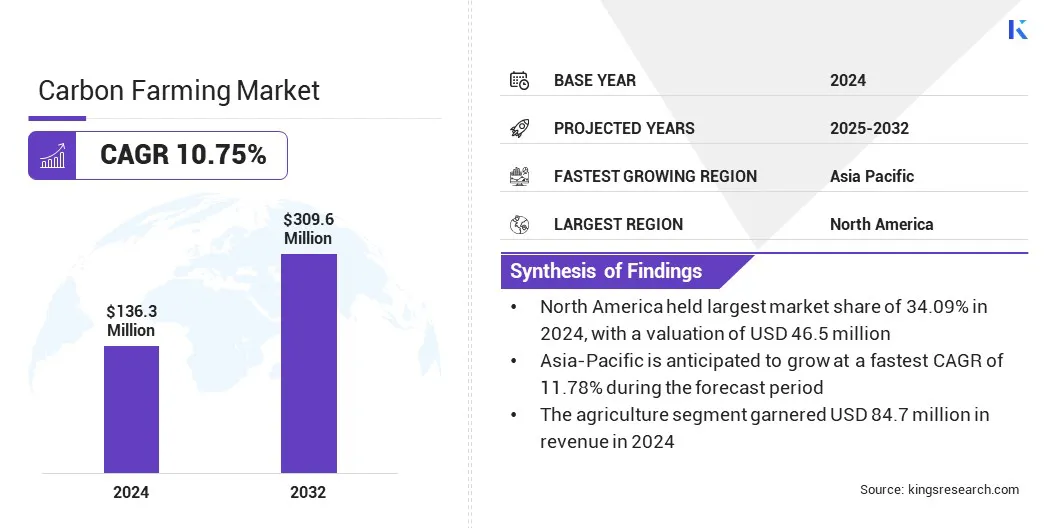

The global carbon farming market size was valued at USD 136.3 million in 2024 and is projected to grow from USD 150.6 million in 2025 to USD 309.6 million by 2032, exhibiting a CAGR of 10.75% during the forecast period.

The growth of the market is fueled by increasing global efforts to reduce greenhouse gas emissions through sustainable land management practices that enhance carbon sequestration in soil and vegetation. Additionally, the expanding voluntary carbon credit ecosystem is creating new revenue opportunities for farmers adopting regenerative practices.

Key Highlights

- The carbon farming industry size was valued at USD 136.3 million in 2024.

- The market is projected to grow at a CAGR of 10.75% from 2025 to 2032.

- North America held a market share of 34.09% in 2024, valued at USD 46.5 million.

- The services segment garnered USD 81.7 million in revenue in 2024.

- The agriculture segment is expected to reach USD 190.6 million by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 11.78% through the projection period.

Major companies operating in the carbon farming industry are Indigo Ag, Inc., Regrow, Terramera Inc., Soil Capital SPRL, AgriWebb, LI-COR, Inc., SourceTrace, AgroCares, Spacenus GmbH, Kheti Buddy, Agreena, Boomitra, Cultyvate., AgriProve INC., Agoro Carbon Alliance, and Continuum Ag.

Governments and international organizations are offering financial incentives and regulatory support to encourage participation in carbon farming initiatives. This is accelerating adoption across agricultural regions, corporate sustainability programs, and environmental offset projects, thereby driving market expansion globally.

- In January 2025, Green Carbon initiated a 6.56-hectare pilot project in Kamphaeng Phet, Thailand, applying alternate wetting and drying (AWD) techniques to reduce methane emissions from rice cultivation. The project forms part of a broader plan to decarbonize 1.5 million hectares of rice paddies and aims to generate carbon credits under Thailand’s Premium T-VER and JCM schemes, offering farmers an estimated return of USD 100 per hectare annually.

Market Driver

Increasing Corporate Commitments to Net-Zero Emissions

The growth of the carbon farming market is strongly driven by the rising number of corporations committing to net-zero emissions targets in response to global climate goals and investor expectations. Companies are actively seeking verifiable, nature-based carbon removal solutions to offset residual emissions as regulatory scrutiny and environmental, social, and governance (ESG) reporting requirements intensify.

This demand is accelerating investment toward carbon farming projects that offer measurable environmental benefits while supporting sustainable land management. The need for credible offsets is also accelerating innovation in monitoring, reporting, and verification systems, ensuring the integrity of credits generated through farming practices.

As corporate climate strategies continue to mature, carbon farming is increasingly viewed as a strategic tool for decarbonization and value creation, thereby contributing significantly to market expansion.

- In March 2025, BASF and Boortmalt produced Europe’s first Verified Impact Units (VIUs) through BASF’s Global Carbon Farming Program on Irish barley farms. The initiative achieved an average reduction of 2.3 t CO₂e per hectare cutting greenhouse gas emissions by nearly 90% using AI-powered xarvio farming tools. SustainCERT independently verified the results, setting a benchmark for scalable, verified agricultural carbon impact.

Market Challenge

Lack of Standardized Measurement and Verification Protocols

The carbon farming market faces a significant challenge due to the lack of standardized measurement and verification protocols for assessing soil carbon sequestration.

Variability in methodologies, data collection techniques, and regional soil characteristics leads to inconsistencies in carbon credit quantification and raises concerns about credit integrity among buyers and investors. This inconsistency hampers trust in carbon offset transactions and limits the scalability of carbon farming initiatives, particularly in regions with limited technical infrastructure.

To overcome these obstacles, market players are investing in the development of harmonized monitoring, reporting, and verification (MRV) frameworks that integrate satellite imagery, digital soil modeling, and remote sensing technologies. In addition, collaboration with third-party certification bodies and the introduction of transparent, science-backed protocols are enhancing credibility and enabling broader market participation.

Market Trend

Expansion of Voluntary Carbon Credit Programs

Expansion of voluntary carbon credit programs is significantly shaping the carbon farming market by creating accessible and performance-based incentives for sustainable land use practices.

These programs are enabling farmers to generate revenue from carbon sequestration activities such as cover cropping, reduced tillage, and agroforestry without being bound by the strict regulatory requirements of compliance markets, which are legally regulated systems requiring entities to meet mandatory emissions reduction targets.. The increasing involvement of corporations seeking high-integrity carbon offsets is driving demand for verifiable and science-backed credits.

This trend is encouraging broader participation from agricultural stakeholders and accelerating the development of robust monitoring, reporting, and verification infrastructure. Additionally, the rise of digital platforms for credit trading and validation is simplifying farmer access and streamlining the credit issuance process.

The growing momentum behind climate-conscious investments and the global uptake of voluntary offsets is positioning these programs as a central pillar in scaling carbon farming efforts and driving long-term market growth.

- In April 2025, Boomitra and the Social Carbon Foundation issued India’s first soil organic carbon removal credits under the URVARA Project, benefiting over 6,000 smallholder farmers. Verified under the Social Carbon methodology, the project uses AI and satellite-based monitoring and is set to generate over 315,000 credits in 20 years, supporting scalable, inclusive carbon farming.

Carbon Farming Market Report Snapshot

|

Segmentation |

Details |

|

By Component |

Product, and Services |

|

By Application |

Agriculture, and Forestry |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Component (Product and Services): The services segment earned USD 81.7 million in 2024 due to rising demand for project development, carbon credit verification, and advisory support for implementing sustainable farming practices.

- By Application (Agriculture and Forestry): The agriculture segment held a share of 62.15% in 2024, attributed to the adoption of regenerative practices and rising demand for soil-based carbon sequestration.

Carbon Farming Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America carbon farming market share stood at at 34.09% in 2024, valued at USD 46.5 million. This dominance is reinforced by the presence of mature voluntary carbon markets, strong policy support for climate-smart agriculture, and widespread adoption of regenerative farming practices. Additionally, growing corporate participation in carbon offset programs and increased farmer awareness of carbon credit benefits are driving regional market expansion.

Advancements in digital monitoring and verification tools are enhancing credit transparency and building confidence among stakeholders. Furthermore, ongoing investment in sustainable land management and collaborative initiatives between governments, agribusinesses, and carbon registries are accelerating the growth of carbon farming across North America.

The Asia-Pacific carbon farming industry is set to grow at a CAGR of 11.78% over the forecast period. This growth is attributed to the increasing adoption of sustainable agricultural practices, rising awareness of climate-related risks, and growing demand for carbon offset opportunities across the region.

The expansion of government-backed pilot programs and climate resilience initiatives is supporting the transition toward regenerative farming models in key Asia-Pacific countries. Collaborative efforts among development agencies, agritech firms, and farmer cooperatives are enabling knowledge transfer and improving access to carbon farming solutions.

Additionally, advancements in digital agriculture platforms and remote sensing technologies are enhancing project monitoring and verification, thereby accelerating market growth across Asia Pacific.

- In April 2025, Bayer issued its first carbon credits in India through the Bayer Rice Carbon Program, which promotes regenerative rice farming practices. The program uses techniques such as direct-seeded rice (DSR) and alternate wetting and drying (AWD) to reduce emissions and improve water efficiency. Farmers across 11 states are expected to generate up to 250,000 tCO₂e in verified carbon credits. The initiative is certified by Gold Standard and supports climate-smart agriculture while improving resource efficiency and farmer incomes.

Regulatory Frameworks

- In the European Union, Regulation (EU) 2024/3012 – Carbon Removal Certification Framework (CRCF) regulates carbon farming and other carbon removal activities. It establishes a voluntary certification system with strict quality criteria, including additionality, permanence, and independent third-party verification, to ensure the credibility and traceability of carbon removals across member states.

- In the U.S., the Growing Climate Solutions Act facilitates the development of voluntary carbon markets in agriculture and forestry. It provides technical assistance and a certification program to help farmers and forest landowners adopt carbon-friendly practices and generate verifiable carbon credits.

- In India, the National Mission for Sustainable Agriculture (NMSA) supports climate-resilient farming practices aligned with carbon farming goals. It promotes soil health management, resource efficiency, and low-emission agricultural methods, creating an enabling environment for carbon sequestration initiatives.

Competitive Landscape

Companies operating in the carbon farming sector are actively expanding their presence by developing end-to-end solutions for project implementation, credit generation, and digital monitoring. Key players are investing in technologies that improve soil carbon measurement, automate data collection, and streamline verification processes to ensure transparency and scalability of carbon offset projects.

They are also utilizing satellite imagery, AI-based modeling, and blockchain platforms to enhance traceability, accuracy, and credit integrity across diverse geographies and farming systems.

Additionally, key players are establishing partnerships with agribusinesses, carbon registries, and sustainability-focused corporations to facilitate farmer onboarding, enable participation in voluntary carbon initiatives and scale project impact across developed and emerging regions.

- In December 2023, Al Dahra and Danish ag‑tech firm Agreena signed a memorandum of understanding at COP28 to launch a carbon farming initiative on Agricost spanning over 55,000 hectares in Romania. The project will adopt regenerative practices like cover crops and reduced tillage under Agreena’s soil‑carbon programme, enabling high‑integrity carbon removal credits via IPCC-aligned MRV systems.

Key Companies in Carbon Farming Market:

- Indigo Ag, Inc.

- Regrow

- Terramera Inc.

- Soil Capital SPRL

- AgriWebb

- LI-COR, Inc.

- SourceTrace

- AgroCares

- Spacenus GmbH

- Kheti Buddy

- Agreena

- Boomitra

- Cultyvate.

- AgriProve INC.

- Agoro Carbon Alliance

- Continuum Ag

Recent Developments (Innovation)

- In September 2024, the EU-funded projects MRV4SOC and MaRViC showcased innovations in carbon farming monitoring, reporting, and verification (MRV) systems during Agriculture Day. Together, they are developing cost-effective, satellite-integrated MRV tools aligned with the EU’s Carbon Removal Certification Framework to enable result-based payments and strengthen credibility in voluntary carbon markets.