buyNow

Bioethanol Market

Bioethanol Market Size, Share, Growth & Industry Analysis, By Feedstock (Starch-based, Sugar-based, Cellulose-based, Others), By Fuel Blend (E10, E20 & E25, E70 & E75, E85, Others), By Application (Transportation Fuel, Power Generation, Cosmetics, Pharmaceutical, Others), and Regional Analysis, 2025-2032

pages: 150 | baseYear: 2024 | release: July 2025 | author: Sharmishtha M.

Market Definition

Bioethanol is a renewable fuel made primarily from biomass materials such as sugarcane, corn, wheat, or other plant-based feedstocks. It is a type of alcohol produced through the fermentation of sugars and is commonly used as a biofuel additive or substitute for gasoline in vehicles.

Bioethanol Market Overview

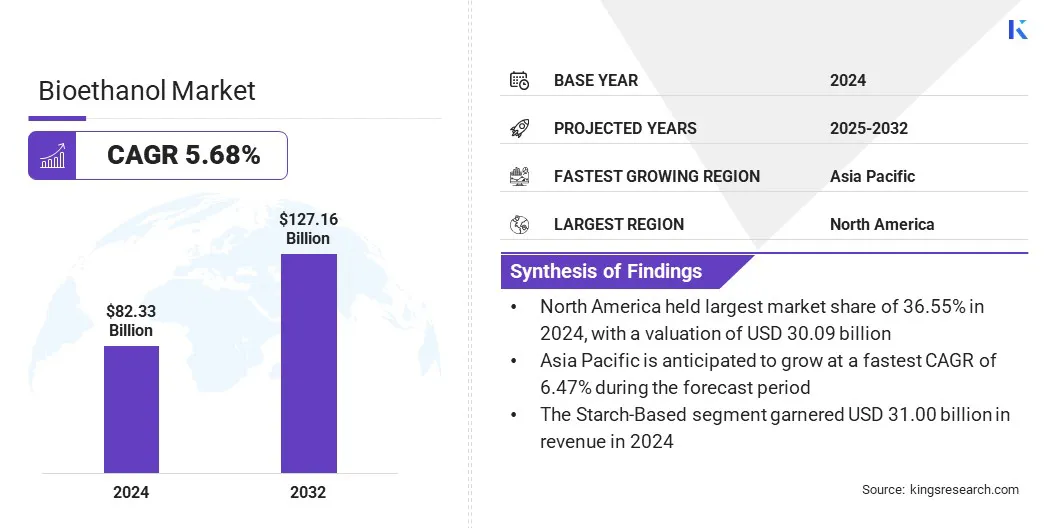

The global bioethanol market size was valued at USD 82.33 billion in 2024, which is estimated to be USD 86.37 billion in 2025 and reach USD 127.16 billion by 2032, growing at a CAGR of 5.68% from 2025 to 2032.

This market is driven by the rising demand for sustainable aviation fuel (SAF), as global aviation players seek to reduce carbon emissions. Bioethanol-based SAF offers a renewable and cleaner alternative to traditional jet fuels.

Key Market Highlights:

- The bioethanol industry size was valued at USD 82.33 billion in 2024.

- The market is projected to grow at a CAGR of 5.68% from 2025 to 2032.

- North America held a market share of 36.55% in 2024, with a valuation of USD 30.09 billion.

- The starch-based segment garnered USD 31.00 billion in revenue in 2024.

- The E10 segment is expected to reach USD 41.71 billion by 2032.

- The pharmaceutical segment is anticipated to register the fastest CAGR of 7.57% during the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 6.47% during the forecast period.

Major companies operating in the bioethanol market are POET LLC, ADM, Valero , The Tereos Group, BBGI Bioethanol Public Company Limited, CREMER OLEO GmbH & Co. K, Cristalco , Shri Parth Petrochem, Buyo India Pvt Ltd, Repsol , INTERIS , Jakson , BHARAT PLUS ETHANOL, abepl, Praj Industries, and others.

The market is registering steady growth, due to the global shift toward cleaner energy and sustainable industrial practices. Increasing environmental awareness, supportive government policies, and technological advancements are encouraging the adoption of bioethanol across various sectors.

Its versatility as a renewable fuel and a raw material for eco-friendly products makes it a preferred choice for reducing carbon emissions. Additionally, expanding research and innovation are opening new avenues for bioethanol applications, further strengthening its role in the green economy.

- In October 2023, Sumitomo Corporation signed an MoU with Korea Alcohol Group’s KC&A to enhance bioethanol imports to Japan. The MOU aims to boost the applications of bioethanol in green fuels and plastics, and strengthen circular economy efforts for a decarbonized future.

Market Driver

Rising Demand for Sustainable Aviation Fuel (SAF)

The market is driven by the increasing emphasis on reducing greenhouse gas emissions in the aviation sector, prompting airlines and aircraft manufacturers to explore sustainable fuel options.

Bioethanol-based SAF is gaining traction as a low-carbon alternative, aligning with international goals like the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), which promotes carbon-neutral aviation growth through emissions offsetting and support for sustainable fuel options.

Its compatibility with existing fuel infrastructure and the ability to be produced from renewable sources make it an attractive option. Strategic collaborations and government support are further accelerating investment and innovation in the market.

- In March 2025, Sumitomo Corporation, Japan Airlines, Airbus, Nippon Paper Industries, and GEI signed an MoU to jointly develop SAF from domestically sourced wood-based bioethanol, aiming to support Japan’s decarbonization goals, regional revitalization, and the creation of a circular and low-carbon economy through local resource utilization.

Market Challenge

High Production Costs

High production costs remain a significant challenge for the bioethanol market, particularly for second-generation bioethanol, which requires advanced technologies and complex processing infrastructure.

These factors make it less cost-competitive compared to conventional fossil fuels. Increased investments in research and development are essential for improving process efficiency and reducing operational costs.

Additionally, government incentives, subsidies, and supportive policy frameworks can help scale production, making second-generation bioethanol more commercially viable and attractive to investors and producers.

Market Trend

Integration with the Automotive Sector

Integration with the automotive sector is emerging as a key trend in the market, as fuel providers and automakers are increasingly collaborating to support the shift toward ethanol-blended fuels. This is driving the development of ethanol-compliant engines and vehicle technologies tailored for blends like E27.

Such efforts ensure optimal engine performance and fuel efficiency and boost consumer confidence and adoption. By aligning fuel innovation with vehicle design, the market is better positioned to meet sustainability goals and expand ethanol usage across diverse vehicle categories.

- In June 2023, Hindustan Petroleum Corporation Limited (HPCL) conducted a pilot study on E27 fuel and ethanol-blended diesel, marking a significant advancement in the bioethanol market. This initiative supports increased ethanol blending in transport fuels, aligning with India’s roadmap for cleaner energy, reduced emissions, and sustainable mobility solutions.

Bioethanol Market Report Snapshot

|

Segmentation |

Details |

|

By Feedstock |

Starch-based, Sugar-based, Cellulose-based, Others |

|

By Fuel Blend |

E10, E20 & E25, E70 & E75, E85, Others |

|

By Application |

Transportation Fuel, Power Generation, Cosmetics, Pharmaceutical, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Feedstock (Starch-based, Sugar-based, Cellulose-based, and Others): The starch-based segment earned USD 31.00 billion in 2024, due to abundant feedstock availability, established processing technologies, and widespread use in fuel blending across major ethanol-producing countries.

- By Fuel Blend (E10, E20 & E25, E70 & E75, E85, and Others): The E10 segment held 34.22% share of the market in 2024, due to government mandates, ease of adoption in existing vehicles, and the growing demand for low-emission transport fuels.

- By Application (Transportation Fuel, Power Generation, Cosmetics, Pharmaceutical, and Others): The transportation fuel segment is projected to reach USD 42.37 billion by 2032, owing to rising vehicle numbers, carbon reduction goals, and blending programs supporting ethanol as a mainstream fuel alternative.

Bioethanol Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America accounted for a market share of 36.55% in 2024, with a valuation of USD 30.09 billion. North America is the dominating region in the bioethanol market, supported by favorable government policies, advanced production technologies, and the increasing demand for clean energy alternatives.

The region benefits from well-established infrastructures for ethanol blending and distribution, along with consistent investments in research and innovation.

Growing environmental awareness and regulatory focus on reducing carbon emissions are further propelling the adoption of bioethanol across various sectors. These factors collectively position North America as a key growth driver in the global market.

The bioethanol industry in Asia Pacific is poised for significant growth at a robust CAGR of 6.47% over the forecast period. It is the fastest-growing market for bioethanol, propelled by escalating energy demand, governmental support for renewable fuels, and expanding biofuel blending policies.

According to the Ministry of Petroleum & Natural Gas, India advanced its ethanol blending target to 17.98% by ESY 2025-26, with steady progress in rising annual blending percentages across recent years.

Rapid industrialization and rising environmental concerns are fueling the adoption of bioethanol across the transport and chemical industries. The market growth is further supported by investments in feedstock cultivation and processing infrastructure, along with efforts in R&D to commercialize advanced bioethanol technologies.

Public–private collaborations and favorable policy incentives are accelerating market entry and capacity expansion. These dynamics are shaping Asia Pacific’s critical role in the global market.

Regulatory Frameworks

- In the U.S., the Renewable Fuel Standard (RFS) program, established by the Energy Policy Act of 2005 and expanded by the 2007 Energy Independence and Security Act, aims to reduce greenhouse gas emissions and promote renewable fuels.

- In India, the National Policy on Biofuels (2018) promotes advanced biofuels, including Second and Third Generation ethanol, biodiesel, and bio-CNG, aiming to reduce import dependency, cut emissions, and foster rural employment through sustainable biofuel production.

- In the European Union (EU), the Renewable Energy Directive sets targets for increased renewable energy use, boosting cooperation among member states to achieve sustainable energy goals and reduce greenhouse gas emissions across the region.

Competitive Landscape

Companies in the bioethanol market are actively investing in research and development to enhance production efficiency, reduce costs, and explore advanced applications such as clean fuels and bio-based chemicals.

Companies are forming strategic partnerships and joint ventures to strengthen supply chains, expand feedstock sourcing, and scale up infrastructure. Efforts are being directed toward developing second-generation bioethanol technologies, diversifying end-use applications, and aligning operations with global sustainability goals.

- In June 2025, Mitsubishi Heavy Industries invested in iPEACE223, a Tokyo-based startup developing clean fuel production technology using bioethanol. This investment aims to advance carbon-neutral energy solutions, reduce environmental impact, and promote the widespread adoption of sustainable fuels, supporting global efforts toward achieving a decarbonized, fossil-free future through innovative and bioethanol-based alternatives.

Key Companies in Bioethanol Market:

- POET LLC

- ADM

- Valero

- The Tereos Group

- BBGI Bioethanol Public Company Limited

- CREMER OLEO GmbH & Co. K

- Cristalco

- Shri Parth Petrochem

- Buyo India Pvt Ltd

- Repsol

- INTERIS

- Jakson

- BHARAT PLUS ETHANOL

- abepl

- Praj Industries

Recent Developments (Joint Venture/MoU)

- In February 2025, Nippon Paper Industries, Sumitomo Corporation, and Green Earth Institute established Morisora Bio Refinery LLC, a joint venture focused on producing and selling bioethanol and biochemicals from woody biomass. Utilizing local forest resources and low-carbon production methods, the venture reflects a broader commitment to decarbonization, energy security, and advancing Japan’s bioeconomy through sustainable, non-food biomass utilization and regional revitalization.

- In February 2025, Bharat Petroleum Corporation Limited (BPCL) signed an MoU with the National Sugar Institute to develop sweet sorghum as a sustainable bioethanol feedstock. BPCL allocated USD 600,000 to enhance ethanol yields, support India’s Ethanol Blended Petrol Programme, and strengthen long-term energy security and rural sustainability through this eco-friendly initiative.