buyNow

Alcohol Ingredients Market

Alcohol Ingredients Market Size, Share, Growth & Industry Analysis, By Product (Yeast, Enzymes, Colorants, Flavors & Salts, Others), By Application (Beer, Spirits, Wine, Others), and Regional Analysis, 2024-2031

pages: 120 | baseYear: 2023 | release: July 2025 | author: Antriksh P.

Market Definition

The market involves the production and sale of key components, such as yeast, enzymes, flavors, and botanicals, used for manufacturing alcoholic beverages. It supports beer, wine, and spirits industries by supplying essential feedstock for the end products. This report examines critical factors, trends, regional developments, and policies that will impact market growth over the forecast period.

Alcohol Ingredients Market Overview

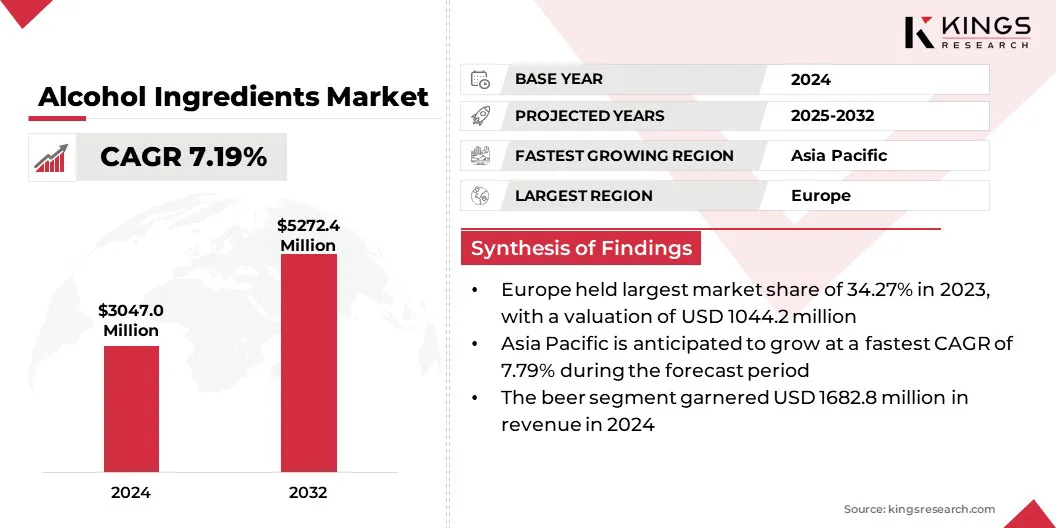

Global alcohol ingredients market size was valued at USD 3047.0 million in 2024, which is estimated to be valued at USD 3243.0 million in 2025 and reach USD 5272.4 million by 2032, growing at a CAGR of 7.19% from 2025 to 2032. The market is witnessing growth driven by increased awareness for natural, organic, and clean-label ingredients, which is pushing manufacturers to introduce more transparent formulations in alcoholic beverages.

Major companies operating in the alcohol ingredients industry are Treatt Plc, AngelYeast Co., ADM, Sensient Technologies Corporation, Döhler GmbH, Kerry Group plc., International Flavors & Fragrances Inc., Cargill, Incorporated., Novonesis Group, dsm-firmenich, AEB Group spa, Rahr Corporation, Breko GmbH, Lesaffre, and American International Foods, Inc., among others.

The market is experiencing surge due to rising global demand for alcoholic products, especially craft and premium beverage. Increasing consumer interest in flavored, low-alcohol, and organic options is encouraging innovation in ingredient formulations.

Moreover, expanding urban populations and changing lifestyles are boosting alcohol consumption, particularly in emerging economies, making the market dynamic and competitive with significant opportunities for new product development.

- According to Treatt Plc’s 2023 annual report, the beverage segment is forecasted to experience a volume growth of over 20% between 2023 and 2028, highlighting the strong global demand for alcoholic products. Trending flavors such as apple, berry, orange, basil, and jalapeño are fueling innovation in ingredient formulations

Key Highlights:

- The alcohol ingredients industry size was recorded at USD 3047.0 million in 2024.

- The market is projected to grow at a CAGR of 7.19% from 2025 to 2032.

- Europe held a market share of 34.27% in 2024, with a valuation of USD 1044.2 million.

- The flavors & salts segment garnered USD 1345.6 million in revenue in 2024.

- The beer segment is expected to reach USD 2865.6 million by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 7.79% during the forecast period.

Market Driver

Growing Alcohol Demand Fuels Shift to Natural Ingredients

As alcohol consumption increases worldwide, the alcohol ingredients market has seen significant growth fueled by rising consumer health consciousness.

- According to Alcohol.org, approximately 446 billion liters of beer, wine, and spirits are consumed globally each year. The vast majority of this consumption is beer, lagers, and cider, totaling nearly 400 billion liters, while wine and spirits account for 26 billion liters and 23 billion liters, respectively.

Today’s consumers seek natural, organic, and clean-label ingredients, demanding transparency and quality in their alcoholic beverages. This shift has led manufacturers to replace artificial additives with healthier alternatives, focusing on plant-based extracts, organic yeasts, and minimal processing.

Brands are upgrading their offerings to meet this demand without compromising flavor or experience. This trend is reshaping product development, attracting label-conscious buyers, and expanding market opportunities globally.

Market Challenge

Competition from Alternative Beverages

The alcohol ingredients market faces significant challenges from the rising popularity of non-alcoholic and low-alcohol beverages, which attract health-conscious consumers and reduce demand for traditional alcoholic drinks. This shift is urging manufacturers to develop new formulations with lower to no alcohol content that maintain flavor and quality.

However, embracing innovation, investing in research for natural and functional ingredients, and diversifying product offerings can help companies stay competitive and meet evolving consumer preferences while sustaining market growth.

Market Trend

Growth of Craft and Small-Batch Production

The alcohol ingredients market has seen significant growth driven by the rise of craft breweries and small-batch distilleries. These producers prioritize unique, high-quality, and often locally sourced ingredients to create distinctive flavors and meet consumer demand for artisanal products.

This trend has fueled the need for diverse raw materials such as specialty grains, exotic botanicals, and innovative flavor additives. As a result, suppliers are expanding their offerings to cater to this niche, fostering innovation and variety within the alcohol ingredients sector.

- In January 2025, Effingut launched two new products featuring Indrayani rice and berry blends as bases ingredients. This showcases the market’s shift toward unique, flavorful, and locally-sourced components.

Alcohol Ingredients Market Report Snapshot

|

Segmentation |

Details |

|

By Product |

Yeast, Enzymes, Colorants, Flavors & Salts, Others |

|

By Application |

Beer, Spirits, Wine, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Product (Yeast, Enzymes, Colorants, Flavors & Salts, Others): The flavors & salts segment earned USD 1345.6 million in 2024, due to growing demand for unique taste profiles and enhanced beverage experiences globally.

- By Application (Beer, Spirits, Wine, Others): The beer segment held 55.23% of the market in 2024, driven by increasing beer consumption and innovation in craft and flavored beer products worldwide.

Alcohol Ingredients Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

.webp) Europe alcohol ingredients market share stood at around 34.27% in 2024 in the global market, with a total value of USD 1044.2 million. Europe remains dominant in the market, due to its well-established alcoholic beverage industry and strong consumer preference for premium, craft, and innovative drinks.

Europe alcohol ingredients market share stood at around 34.27% in 2024 in the global market, with a total value of USD 1044.2 million. Europe remains dominant in the market, due to its well-established alcoholic beverage industry and strong consumer preference for premium, craft, and innovative drinks.

- According to Eurostat, the European Union exported alcoholic beverages worth USD 2,884.91 billion in 2024, marking a 10.9% growth compared to 2019. Countries like Germany, France, and the UK lead in production and consumption, supported by advanced R&D and stringent quality standards.

The region’s focus on natural and organic ingredients further boosts market demand. Europe also exports alcoholic beverages and ingredients, strengthening its global influence and driving steady growth.

Asia Pacific alcohol ingredients industry is poised for significant growth at a robust CAGR of 7.79% over the forecast period. It is the fastest-growing market for alcohol ingredients, driven by rising disposable incomes, urbanization, and increasing consumer interest in premium and craft alcoholic beverages.

Growing awareness regarding health and wellness is driving the demand for natural and clean-label ingredients. Additionally, expanding nightlife culture and evolving drinking habits in China, India, and Japan fuel market growth. Innovation by local manufacturers and rising exports also strengthen the region’s position as a dynamic and rapidly expanding market.

Regulatory Frameworks

- In the U.S., the Federal Alcohol Administration Act regulates alcohol production, import, and wholesale by requiring permits, ensuring authentic labeling and advertising and preventing unfair trade practices.

- In the EU, Regulation No 1169/2011 mandates alcoholic beverages to display ingredient lists and nutrition information on labels, ensuring transparency and integrity.

Competitive Landscape

Major players in the alcohol ingredients industry are developing natural, organic, and clean-label ingredients on par with consumer demand for healthier options. They are investing in research to create unique flavors, improve product safety, and enhance functionality while minimizing artificial additives.

Collaboration with research institutions and startups is common to explore novel bioactive compounds and sustainable sourcing. Additionally, firms are adopting advanced technologies for better ingredient extraction and quality control, aiming to deliver premium, and authentic alcoholic beverages globally.

List of Key Companies in Alcohol Ingredients Market:

- Treatt Plc

- AngelYeast Co.

- ADM

- Sensient Technologies Corporation

- Döhler GmbH

- Kerry Group plc.

- International Flavors & Fragrances Inc.

- Cargill, Incorporated.

- Novonesis Group

- dsm-firmenich

- AEB Group spa

- Rahr Corporation

- Breko GmbH

- Lesaffre

- American International Foods, Inc.

Recent Developments (Product Launch)

- In September 2024, IFF introduced DIAZYME NOLO, a breakthrough enzyme designed to improve the taste, efficiency, and sustainability of no- and low-alcohol beer production. By enhancing taste and reducing fermentation without increasing alcohol content, it allows brewers to meet growing demand for healthier beverages while cutting operational costs and environmental impact, all without new equipment investments.