buyNow

Winter Sports Equipment Market

Winter Sports Equipment Market Size, Share, Growth & Industry Analysis, By Product Type (Skiing Equipment, Snowboarding Equipment, Ice Skating Equipment, Others), By End User (Women, Men, Kids), By Distribution Channel (Specialty Stores, Online Stores, Supermarkets & Hypermarkets, Others), and Regional Analysis, 2025-2032

pages: 170 | baseYear: 2024 | release: July 2025 | author: Versha V.

Market Definition

Winter sports equipment encompasses a diverse range of specialized gear designed for use in snow- and ice-based activities, both recreational and professional. It includes skis, snowboards, ice skates, poles, helmets, goggles, and insulated protective clothing. This equipment is engineered to deliver optimal performance, enhance user safety, and endure harsh winter conditions.

Winter Sports Equipment Market Overview

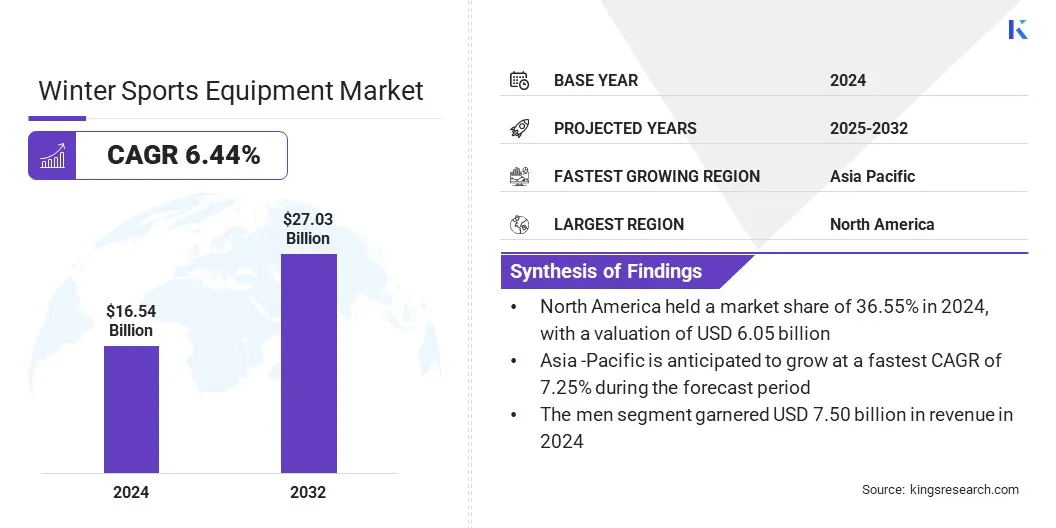

The global winter sports equipment market size was valued at USD 16.54 billion in 2024 and is projected to grow from USD 17.46 billion in 2025 to USD 27.03 billion by 2032, exhibiting a CAGR of 6.44% during the forecast period.

The market growth is attributed to strong government support and initiatives that are promoting winter sports participation, expanding tourism, and enhancing infrastructure development. The market is further driven by manufacturers introducing customized and personalized equipment solutions, including tailored fits and performance features, to meet the evolving preferences of individual users.

Key Highlights:

- The winter sports equipment industry size was valued at USD 16.54 billion in 2024.

- The market is projected to grow at a CAGR of 6.44% from 2025 to 2032.

- North America held a market share of 36.55% in 2024, with a valuation of USD 6.05 billion.

- The skiing equipment segment garnered USD 6.04 billion in revenue in 2024.

- The men segment is expected to reach USD 11.62 billion by 2032.

- The online stores segment is anticipated to register the fastest CAGR of 7.77% over the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 7.25% through the forecast period.

Major companies operating in the winter sports equipment market are Amer Sports, K2 Snow, ROSSIGNOL Group, Burton Snowboards, Atomic Austria GmbH, Volkl US, ELAN D.O.O., Bauer Hockey LLC, Sport Maska Inc, GRAF SKATES AG, SCOTT Sports SA, Brav Sweden AB, Columbia Sportswear Company, Decathlon, and Black Diamond Equipment Ltd.

The growing public interest in ice and snow sports across China is significantly driving the market. Increased participation in activities such as skiing, snowboarding, and ice skating is leading to higher demand for specialized gear, safety equipment, and winter apparel. This growth is further supported by government initiatives promoting winter sports as part of broader fitness and tourism development goals.

- In December 2024, the Economic Department of the State General Administration of Sport reported that approximately 313 million people in China have participated in ice and snow sports or related leisure activities since the 2022 Beijing Winter Olympics. This surge in participation is supporting the growth of the market by increasing the demand for gear, apparel, and related infrastructure across the country.

Market Driver

Government Support and Initiatives

The rising popularity of winter sports and recreational snow activities is driving the winter sports equipment market. The growing participation in skiing, snowboarding, and ice skating is steadily expanding the demand for specialized equipment, apparel, and supporting infrastructure.

Winter sports equipment offers safety, comfort, and performance benefits essential for both amateur and professional users. Moreover, the growing availability of winter tourism destinations and the increasing presence of related products in retail and online platforms are further accelerating the market growth.

- In November 2024, China announced a national plan to expand its ice and snow economy, focusing on winter sports, tourism, and equipment manufacturing. The initiative targets a projected market value of approximately USD 211 billion by 2030.

Market Challenge

High Equipment Costs

A key challenge in the winter sports equipment market is the high cost associated with purchasing and maintaining specialized gear. Quality equipment such as skis, snowboards, boots, and protective apparel requires significant upfront investment, which can be a barrier for new or casual participants.

Ongoing expenses for maintenance, seasonal upgrades, and accessories further increase the financial burden. These costs are particularly challenging for consumers in price-sensitive markets and can limit broader participation in winter sports activities, affecting overall market growth.

Market players are offering more affordable and entry-level product lines that deliver high performance without the premium pricing. Manufacturers and retailers are also promoting rental and demo programs that enable consumers to access quality gear at lower short-term costs.

Brands are providing flexible financing options and loyalty discounts to reduce upfront expenses. Additionally, partnerships with ski resorts and local clubs are facilitating bundled deals and package offerings, enhancing affordability and encouraging broader participation in winter sports.

Market Trend

Customization and Personalization

A key trend in the winter sports equipment market is the growing demand for customized and performance-oriented gear. Consumers are prioritizing products that offer a personalized fit, enhanced comfort, and improved control to suit their individual needs and skill levels.

This trend is prompting manufacturers to incorporate technologies such as adjustable fit systems, heat-moldable materials, and ergonomic designs. These innovations are enhancing overall user experience, encouraging wider participation, and strengthening brand loyalty in an increasingly competitive market.

- In January 2025 Salomon launched the SUPRA Ski Boots, featuring a dual BOA system. It allows skiers to independently adjust the upper cuff and lower shell for enhanced fit, control, and comfort. Featuring ExoWrap and Custom Shell HD technologies, the boot delivers a personalized, performance-oriented experience.

Winter Sports Equipment Market Report Snapshot

|

Segmentation |

Details |

|

By Product Type |

Skiing Equipment, Snowboarding Equipment, Ice Skating Equipment, Snow Sleds & Snow Tubes, Others |

|

By End-User |

Women, Men, Kids |

|

By Distribution Channel |

Specialty Stores, Online Stores, Supermarkets & Hypermarkets, Department Stores, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Product Type (Skiing Equipment, Snowboarding Equipment, Ice Skating Equipment, Snow Sleds & Snow Tubes, and Others): The skiing equipment segment earned USD 6.04 billion in 2024, due to the rising participation of people in alpine skiing and increased demand for advanced performance gear.

- By End-User (Women, Men and Kids): The men segment held 45.33% share of the market in 2024, due to higher spending on performance-focused winter sports equipment and greater participation rates.

- By Distribution Channel (Specialty Stores, Online Stores, Supermarkets & Hypermarkets, and Department Stores): The specialty stores segment is projected to reach USD 9.87 billion by 2032, owing to expert guidance, tailored product offerings, and in-store fitting services.

Winter Sports Equipment Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America winter sports equipment market share stood at around 36.55% in 2024, with a valuation of USD 6.05 billion. This dominance is attributed to the strong retail infrastructure and widespread consumer engagement across the region.

The region is registering steady growth as major retail networks continue to expand their presence and strengthen supplier–retailer relationships. Retailers with operations across multiple states and centralized management are contributing to more streamlined distribution and broader market coverage in the region.

Moreover, the continued development of trade events that support product visibility and partnership growth is supporting market expansion in the region. The presence of established channels for product display and sales coordination in the region attracts manufacturers targeting national and regional markets through structured distribution systems, thereby fueling the market in the region.

- In February 2024, Snowsports corporation merged with Sports Specialists Ltd to form a Winter Sports Retailers, Inc. (WSR), establishing the largest network of specialty winter sports retailers in the U.S. With over 300 locations across 33 states, WSR aims to enhance the collaboration between brands and retailers, improve communication, and strengthen the consumer experience in an evolving winter sports industry.

The winter sports equipment industry in Asia Pacific is set to grow at a robust CAGR of 7.25% over the forecast period. This growth is attributed to the increasing participation in winter activities and the ongoing development of seasonal tourism infrastructure across Asia Pacific.

Countries in the region are investing in advanced resort facilities and expanding service offerings that improve accessibility and enhance user experience. Governments are supporting large-scale events and tourism initiatives that promote the broader adoption of skiing, snowboarding, and recreational snow sports, further accelerating the demand for winter sports equipment.

The introduction of smart robotic technologies by public and private stakeholders to improve resort operations and enhance visitor engagement is contributing to the market growth. The region is witnessing a shift in consumer interest, as younger populations engage more actively in winter sports, and this behavioral trend is reinforcing the steady growth of the market.

- In November 2024, China integrated AI technologies and innovative services at ski resorts, such as robotic patrol dogs at Lianhuashan in Jilin Province, as part of its broader strategy to boost participation in winter sports.

Regulatory Frameworks

- In the U.S., the Consumer Product Safety Commission (CPSC) oversees safety standards for winter sports equipment, including helmets, skis, snowboards, and skates. It enforces regulations related to product design, labeling, and injury prevention. The CPSC monitors recalls, conducts product testing, and mandates compliance with ASTM & ISO safety standards across manufacturing and imports.

- In China, the General Administration of Sport of China (GASC) regulates quality and safety standards for winter sports equipment used in domestic events and recreational markets. The GASC collaborates with national quality inspection agencies to oversee equipment certification, performance testing, and the promotion of winter sports safety in line with China’s national fitness and sports policies.

- In India, the Bureau of Indian Standards (BIS) governs quality certification for winter sports equipment, focusing on imported goods and growing domestic manufacturing. The BIS develops and enforces performance, material, and safety standards for products like skis, snowboards, and helmets.

- In the UK, the British Standards Institution (BSI) formulates and monitors safety & performance standards for winter sports equipment in the UK. It aligns regulations with international norms such as EN and ISO standards, overseeing testing protocols for durability, material safety, and design.

Competitive Landscape

Major players in the winter sports equipment industry are focusing on enhancing distribution efficiency and retail engagement by supporting regional trade initiatives. They are aligning with newly formed trade organizations that facilitate streamlined interaction between brands and retailers.

Key players and trade organizations are leveraging seasonal trade shows to improve market accessibility, reduce operational costs, and strengthen local supply chains. These strategies are helping brands maintain visibility, expand product reach, and adapt to changing retail dynamics in regions affected by seasonal variability and logistical challenges.

- In January 2025, the Midwest Winter Sports Reps Association merged with Outdoor Reps Association to form the Midwest Professional Reps Organization (M-Pro), aiming to streamline support for sales reps and retailers across outdoor and winter sports categories. The new organization plans to host seasonal trade shows in key Midwest locations, offering cost-effective and regionally accessible platforms for brand-retailer engagement.

Key Companies in Winter Sports Equipment Market:

- Amer Sports

- K2 Snow

- ROSSIGNOL Group

- Burton Snowboards

- Atomic Austria GmbH

- Volkl US

- ELAN, D.O.O.

- Bauer Hockey, LLC

- Sport Maska Inc

- GRAF SKATES AG

- SCOTT Sports SA

- Brav Sweden AB

- Columbia Sportswear Company

- Decathlon

- Black Diamond Equipment, Ltd.

Recent Developments (Product Launch)

- In November 2024, BOSS launched a ski capsule collection featuring technical outerwear and après-ski apparel. This collection targets professional athletes and lifestyle consumers in the luxury skiwear segment.

freqAskQues