buyNow

Tidal Power Market

Tidal Power Market Size, Share, Growth & Industry Analysis, By Method (Tidal Stream, Tidal Barrage, Tidal Turbine), By Application (Power Generation, Desalination, Others), and Regional Analysis, 2024-2031

pages: 120 | baseYear: 2023 | release: February 2025 | author: Versha V.

Market Definition

The tidal power industry encompasses the development, installation, and operation of technologies that convert ocean tides into electricity, including tidal stream and tidal range systems. As a renewable energy sector, it supports global efforts to reduce carbon emissions and reliance on fossil fuels.

Tidal Power Market Overview

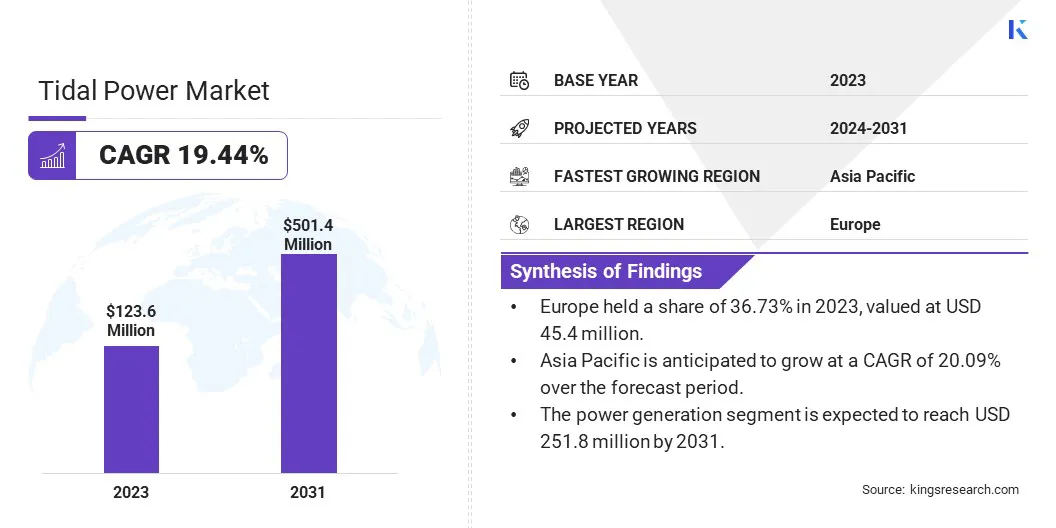

The global tidal power market size was USD 123.6 million in 2023, which is estimated to be valued at USD 144.6 million in 2024 and is projected to reach USD 501.4 million by 2031, growing at a CAGR of 19.44% from 2024 to 2031.

The increasing global demand for clean, renewable energy to combat climate change is driving the growth of the market. With sustainability becoming a priority for sustainability, tidal energy emerges as a reliable, low-carbon solution to meet growing energy needs while reducing environmental impact.

Major companies operating in the tidal power industry are Nova Innovation Limited, SAE, Tidal Bridge BV, Hydroquest SAS, ORPC, Inc, Orbital Marine Power, SBS INTL LTD., Minesto AB, ANDRITZ AG, MAKO Tidal Turbines Pty Ltd, AW Energy, Nautricity, Verdant Power, Inc., and others.

The market is emerging as an essential component of the global transition to sustainable energy. With its potential to provide consistent, renewable energy, tidal power presents a promising alternative to traditional fossil fuels. Growing interest in tidal power underscores its potential to enhance the renewable energy mix with reliable, weather-independent output.

- In Nov 2023, Orbital Marine Power partnered with Euclaire Tidal to supply its 2.4MW O2X floating tidal stream turbine at Canada's FORCE facility in Minas Passage. This collaboration marks a key step in advancing tidal energy technology in dynamic tidal environments.

Key Highlights:

Key Highlights:

- The global tidal power market size was recorded at USD 123.6 million in 2023.

- The market is projected to grow at a CAGR of 19.44% from 2024 to 2031.

- Europe held a share of 36.73% in 2023, valued at USD 45.4 million.

- The tidal barrage segment garnered USD 56.1 million in revenue in 2023.

- The power generation segment is expected to reach USD 251.8 million by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 20.09% over the forecast period.

Market Driver

"Global Shift Toward Renewable Energy"

The global shift toward sustainable energy is contributing significantly to the growth of the tidal power market as the need to reduce greenhouse gas emissions and address climate change intensifies. Tidal power, a dependable and consistent renewable energy source, is increasingly recognized for its potential.

As a reliable renewable source, tidal power offers a distinct advantage over solar and wind energy, which depend on variable weather conditions. Governed by predictable tidal cycles, it enhances energy security and strengthens the renewable energy portfolio.

- According to the International Energy Agency (IEA), global renewable capacity is projected to grow 2.7 times by 2030, with 5,500 gigawatts (GW) of new capacity expected under current policies and market conditions.

The market is set to witness significant growth, fueled by advancements in technology, improved grid integration, and energy storage solutions, reinforcing its role in the transition to a sustainable, low-carbon energy future.

- Minesto’s Dragon 12 tidal power plant, launched in February 2024 in the Faroe Islands, uses an innovative subsea kite system to generate 1.2 MW of power, contributing to the U.K. national grid.

Market Challenge

"High Initial Capital Investment"

The tidal power market faces significant challenges due to high installation costs. Unlike wind or solar energy, it requires complex engineering and specialized infrastructure, leading to substantial upfront investments.

Harsh ocean conditions, including corrosion and strong currents, demand durable materials and advanced technology, further increasing costs. Advancements in materials, cost-efficient engineering, and automation can help mitigate these challenges, enhancing the economic viability of tidal energy.

Market Trend

"Strategic Partnerships between Governments and Companies"

Strategic partnerships between companies and governments are shaping the tidal power market facilitating technology development, funding, and regulatory support.

Governments are leveraging these partnerships to meet renewable energy targets, while companies gain access to financial backing and policy incentives. Such synergies are vital for scaling up tidal energy projects, overcoming technical challenges, and expanding the market, thus advancing a sustainable energy future.

- In October 2023, Orbital Marine Power teamed up with key organizations under the EU Horizon Europe Programme for the EURO-TIDES project. This initiative focuses on advancing Orbital's floating tidal stream technology with support from EMEC, RWTH Aachen, and the University of Edinburgh.

Tidal Power Market Report Snapshot

|

Segmentation |

Details |

|

By Method |

Tidal Stream, Tidal Barrage, Tidal Turbine |

|

By Application |

Power Generation, Desalination, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Method (Tidal Stream, Tidal Barrage, and Tidal Turbine): The tidal barrage segment earned USD 56.1 million in 2023, due to its ability to generate large-scale, consistent energy from tidal movements.

- By Application (Power Generation, Desalination, and Others): The power generation segment held a share of 48.94% in 2023, fueled by the growing demand for renewable energy solutions that offer stable, reliable electricity production from tidal currents and flows.

Tidal Power Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Europe tidal power market captured a share of around 36.73% in 2023, valued at USD 45.4 million. This dominance is reinforced by its commitment to renewable energy and sustainability.

Europe tidal power market captured a share of around 36.73% in 2023, valued at USD 45.4 million. This dominance is reinforced by its commitment to renewable energy and sustainability.

With ambitious EU policies such as the European Green Deal and Renewable Energy Directive, the region is accelerating the transition to clean energy. These policies support tidal energy adoption through financial incentives, grants, and subsidies aimed at advancing research and commercialization.

Increased public and private investments and partnerships are fueling the expansion of tidal power technologies and infrastructure, positing Europe as a key market for tidal energy.

- In January 2024, Ifremer and HydroQuest launched VERTI-Lab, a joint initiative in France dedicated to offshore tidal turbines. Supported by the National Research Agency, the lab focuses on developing analytical tools, optimizing tidal system design, and advancing commercial tidal farms.

Asia Pacific tidal power industry is likely to grow at a robust CAGR of 20.09% over the forecast period. This rapid growth is boosted by increasing investments in renewable energy and the availability of vast coastal and tidal resources.

Leading nations such as China, South Korea, and Australia are leading tidal energy development efforts, supported by extensive coastlines and favorable government policies. Additionally, Southeast Asia’s numerous islands and coastal states present significant potential for tidal power projects, establishing the region as a key area for market expansion.

- In February 2024, Energies PH, through San Bernardino Ocean Power, partnered with Inyanga Marine Energy to build Southeast Asia’s first tidal power plant at Capul Island, Philippines. The 1MW project uses HydroWing technology to provide 24/7 sustainable energy.

Regulatory Framework

- The European Green Deal serves as the EU’s growth strategy, aiming to achieve carbon neutrality by 2050, reduce pollution, and restore ecological balance.

- In the U.S., the Bureau of Ocean Energy Management manages the sustainable development of U.S. Outer Continental Shelf (OCS) energy, mineral, and geological resources, ensuring environmental and economic responsibility.

Competitive Landscape

The tidal power industry is characterized by a large number of participants, including both established corporations and emerging players. Partnerships between companies in the market are essential for advancing technology and accelerating project development.

By pooling resources, expertise, and technologies, these collaborations enhance innovation, reduce costs, and streamline regulatory processes. These alliances enable the sharing of risks and ensure the successful deployment of large-scale tidal energy projects, promoting the growth and commercialization of sustainable tidal power solutions.

- In November 2024, SAE Renewables partnered with Proteus Marine Renewables, SKF Marine, and GE Vernova’s Power Conversion business to expand the MeyGen tidal project, increasing its capacity from 6MW to 65MW. This phase will create hundreds of jobs in Scotland.

List of Key Companies in Tidal Power Market:

- Nova Innovation Limited

- SAE

- Tidal Bridge BV

- Hydroquest SAS

- ORPC, Inc

- Orbital Marine Power

- SBS INTL LTD.

- Minesto AB

- ANDRITZ AG

- MAKO Tidal Turbines Pty Ltd

- AW Energy

- Nautricity

- Verdant Power, Inc.

Recent Developments (Expansion/Partnership/Agreement)

- In May 2024, Orbital Marine Power chose Global Energy Group as its preferred supplier for turbine manufacturing and assembly for Orkney projects under the UK Government’s CfD auctions. Production will begin at Port of Nigg, with power generation expected by 2026.

- In June 2024, Minesto and Faroese utility Sev renewed their power purchase agreement (PPA), emphasizing tidal energy’s role in a fully renewable energy mix. The updated PPA covers three tidal plants in Vestmanna, features enhanced pricing, and extends energy sourcing from Minesto’s tidal kites.

- In October 2024, ORPC, in collaboration with Queen’s University Belfast, deployed and tested a next-generation marine hydrokinetic turbine at Strangford Lough Tidal Test Site. The project, part of the X-Flow initiative, utilizes ORPC’s cross-flow technology to leverage tidal and river currents.

freqAskQues