buyNow

Home Renovation Market

Home Renovation Market Size, Share, Growth & Industry Analysis, By Renovation Type (Interior Renovation, Exterior Renovation, System Upgrades), By End User (Residential, Commercial), By Project Type (DIY (Do-It-Yourself), Professional Renovation), By Distribution Channel, and Regional Analysis, 2025-2032

pages: 180 | baseYear: 2024 | release: July 2025 | author: Versha V.

Market Definition

Home renovation is the process of upgrading or improving an existing residential space to enhance its appearance, functionality, or overall value. This can include tasks such as remodeling interiors, updating kitchens or bathrooms, installing new flooring, painting, or making structural modifications to meet modern design and living standards.

It involves repairing outdated elements, improving energy efficiency, or adding smart home features. Home renovation is widely applied in residential property maintenance, value enhancement for resale, lifestyle upgrades, and compliance with evolving safety & energy regulations.

Home Renovation Market Overview

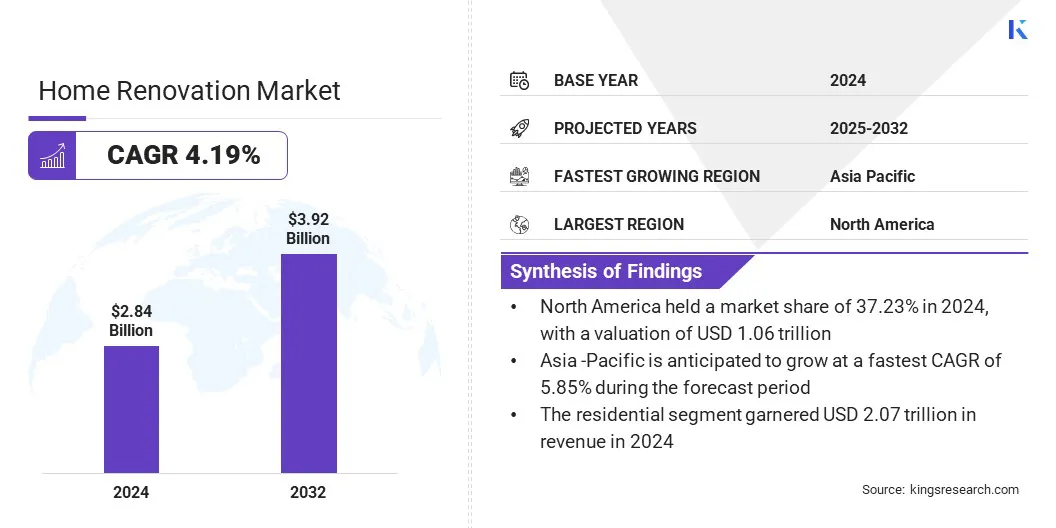

The global home renovation market size was valued at USD 2.84 trillion in 2024 and is projected to grow from USD 2.94 trillion in 2025 to USD 3.92 trillion by 2032, exhibiting a CAGR of 4.19% during the forecast period.

The market growth is attributed to increased remodeling activity and consumer preference for move-in ready homes, encouraging homeowners to invest in upgrades that enhance property appeal and functionality. The market is further driven by the expanding adoption of Do-It-Yourself (DIY) renovation practices as homeowners use online tutorials, virtual design tools, and accessible products to manage renovation projects independently.

Key Highlights:

- The home renovation industry size was valued at USD 2.84 trillion in 2024.

- The market is projected to grow at a CAGR of 4.19% from 2025 to 2032.

- North America held a market share of 37.23% in 2024, with a valuation of USD 1.06 trillion.

- The interior renovation segment garnered USD 1.51 trillion in revenue in 2024.

- The residential segment is expected to reach USD 2.89 trillion by 2032.

- The DIY (do-it-yourself) segment is anticipated to grow at a CAGR of 5.27% over the forecast period.

- The online platforms & marketplaces segment held a market share of 45.00% in 2024.

- The market in Asia Pacific is anticipated to grow at a CAGR of 5.85% through the projection period.

Major companies operating in the home renovation market are Home Depot, Lowe's, Masco Corporation, Kingfisher plc, Bunnings Group Limited, Travis Perkins Group, ADEO, OBI, Menard, Inc, The Sherwin-Williams, Stanley Black & Decker, Inc, Owens Corning, Pella Corporation, Andersen Windows, Inc, and Houzz Inc.

The steady growth of the home improvement market is reinforcing the expansion of the market. Rising consumer spending, supported by accessible financing options, is driving the demand for home upgrades across residential properties.

- According to the Home Improvement Research Institute, the total home improvement market was valued at approximately USD 574.3 billion in 2024, is projected to reach USD 593.8 billion in 2025, and is expected to grow to around USD 688 billion by 2029.

Market Driver

Increased Remodeling Activity and Consumer Preference for Move-in Ready Homes

The surge in remodeling spending and rising preference for move-in ready homes are driving the home renovation market. Homebuyers are increasingly prioritizing properties that require minimal repairs or upgrades, prompting homeowners to invest in remodeling projects that enhance appeal, functionality, and market value.

Homeowners are focusing their renovation efforts on modern layouts, upgraded interiors, and energy-efficient features to meet evolving buyer expectations. Moreover, the growing emphasis on turnkey living experiences is accelerating renovation activity across residential markets.

- According to the 2025 Remodeling Impact Report by the National Association of REALTORS, Americans spent an estimated USD 603 billion on home remodeling in 2024. The report highlights a growing emphasis on home quality, with 46% of home buyers indicating that they are less willing to compromise on the condition of a home when making a purchase.

Market Challenge

Shortage of Skilled Labor

A key challenge in the home renovation market is the shortage of skilled labor across essential trades such as carpentry, plumbing, and electrical work. The limited availability of trained professionals is causing delays, increasing labor costs, and impacting overall workmanship quality.

Contractors are facing difficulty in meeting project demand while maintaining consistent standards. This persistent labor gap is restricting renovation capacity and limiting the market’s ability to grow in line with rising consumer expectations for timely and high-quality upgrades.

Market players are investing in workforce development programs, offering apprenticeships, and partnering with trade schools to build a skilled talent pipeline. They are adopting labor-saving construction technologies such as prefabrication and modular solutions to reduce on-site labor dependency.

Additionally, they are adopting digital project management tools to improve efficiency and coordination in planning, scheduling, resource allocation, and real-time communication across renovation projects. Market players are enhancing employee retention through competitive wages, training opportunities, and better working conditions to maintain consistent project delivery and meet the rising demand for renovation.

Market Trend

Expanding Adoption of Do-It-Yourself (DIY) Renovation Practices

A key trend in the home renovation market is the growing adoption of Do-It-Yourself (DIY) renovation practices. Homeowners are increasingly taking on remodeling tasks themselves, supported by the widespread availability of online tutorials, virtual planning tools, and affordable home improvement products.

This trend is prompting retailers to introduce user-friendly solutions, step-by-step guidance, and AI-powered virtual assistants to simplify project execution. The shift toward self-managed renovations is expanding consumer engagement and redefining the planning, sourcing, and execution of renovation projects.

- In March 2025, Lowe’s launched Mylow, the first AI-powered virtual advisor for home improvement, to enhance customer support and project execution. Developed in collaboration with OpenAI, Mylow provides real-time, conversational guidance on renovation questions, product recommendations, and DIY instructions.

Home Renovation Market Report Snapshot

|

Segmentation |

Details |

|

By Renovation Type |

Interior Renovation (Kitchen Remodeling, Bathroom Renovation, Flooring, Interior Painting, Lighting Upgrades, HVAC System Upgrades, Others), Exterior Renovation (Roofing, Siding & Exterior Painting, Windows & Doors Replacement, Outdoor Living Spaces, Garage Renovation, Others), System Upgrades (Plumbing, Electrical, Energy Efficiency Retrofits, Others) |

|

By End-User |

Residential (Single-Family Homes, Multi-Family Homes) Commercial (Small Offices, Retail Spaces, Hospitality) |

|

By Project Type |

DIY (Do-It-Yourself), Professional Renovation (Partial Renovation. Full/Home-wide Renovation) |

|

By Distribution Channel |

Home Improvement Retail Stores , Online Platforms & Marketplaces, Specialized Contractors and Builders, Architectural and Design Firms |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Renovation Type (Interior Renovation, Exterior Renovation, and System Upgrades): The interior renovation segment earned USD 1.51 trillion in 2024, due to the rising consumer focus on modernized layouts, esthetic upgrades, and functional improvements.

- By End-User (Residential, and Commercial): The residential segment held 73.00% share of the market in 2024, due to the growing investments of homeowners in personalized living spaces and property value enhancement.

- By Project Type (DIY (Do-It-Yourself), and Professional Renovation): The professional renovation segment is projected to reach USD 2.02 trillion by 2032, owing to the rising demand for complex, high-value remodeling handled by skilled contractors.

- By Distribution Channel (Home Improvement Retail Stores, Online Platforms & Marketplaces, Specialized Contractors and Builders, and Architectural and Design Firms): The online platforms & marketplaces segment is anticipated to grow at a CAGR of 5.70% over the forecast period, due to increased digital engagement and preference for convenient, guided product sourcing.

Home Renovation Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America home renovation market share stood at around 37.23% in 2024, with a valuation of USD 1.06 trillion. This dominance is attributed to the presence of large-scale distributors and the strategic expansion of supply networks that are supporting extensive renovation activity across the region.

The region is registering consistent growth as companies are enhancing their service capabilities through acquisitions that are boosting material availability and improving fulfillment infrastructure across residential and commercial segments. The market is also benefiting from an increase in the demand for professional contractors, which is prompting suppliers to extend product lines and delivery networks across multiple building material categories.

The market is expanding from increased investment in jobsite delivery fleets and integrated platforms that enable faster and more reliable access to building materials. Distributors in the region are prioritizing operational efficiency and customer-centric service models, which is further supporting the market expansion in the region.

- In June 2025, the Home Depot entered into an agreement to acquire GMS Inc., a leading distributor of specialty building products in North America. Valued at approximately USD 4.3 billion, the acquisition aims to strengthen Home Depot’s presence in the professional renovation market by expanding its product offerings, distribution footprint, and jobsite delivery capabilities.

The home renovation industry in Asia Pacific is set to grow at a robust CAGR of 5.85% over the forecast period. This growth is attributed to the increasing focus on high-quality interior construction across luxury and commercial spaces in the region.

Market players in the region are expanding their presence by acquiring firms with specialized capabilities in fit-out and custom furniture production, which is driving project volume and value of high-end renovation projects across luxury retail and residential segments. The market is registering a steady rise in demand for integrated renovation services, as clients prefer end-to-end execution that covers design, build, and installation under a single provider.

The market growth in Asia Pacific is attributed to the rising demand for personalized and design-driven interiors in fast-developing economies across ASEAN. Players in the region are investing in skilled talent and advanced technical capabilities to deliver complex renovation projects that meet evolving esthetic and functional expectations. This development is driving the volume and value of high-end renovation work in the region, further supporting the market growth.

- In November 2024, Shimizu Corporation acquired Singapore-based Grandwork Interior Pte Ltd, a leading interior fit-out company specializing in luxury retail spaces. The acquisition aims to strengthen Shimizu’s presence in the ASEAN market and expand its global business domain by leveraging Grandwork’s expertise in high-end interior construction, custom furniture manufacturing, and established relationships with global luxury brands.

Regulatory Frameworks

- In the U.S., the Department of Housing and Urban Development (HUD) oversees aspects of home renovation through housing standards, building codes, and energy efficiency guidelines. HUD regulates renovation-related safety, accessibility, and code compliance under programs like FHA 203(k). It promotes fair housing, structural integrity, and sustainable practices in residential improvement projects nationwide.

- In China, the Ministry of Housing and Urban-Rural Development (MOHURD) regulates the home renovation sector by enforcing building codes, construction safety standards, and energy efficiency policies. The MOHURD oversees renovation approvals, urban planning integration, and environmental protection in residential construction, ensuring quality and uniformity in home improvement practices across provinces.

- In India, the Bureau of Indian Standards (BIS) governs the market by setting technical standards for construction materials, electrical systems, plumbing, and structural safety. BIS ensures that renovations adhere to national norms such as IS codes, promoting durability, energy efficiency, and public safety. It influences new builds and remodeling works.

- In the UK, local planning authorities, regulated by the Planning Inspectorate, manage home renovation through building regulations and planning permissions. They oversee structural changes, listed buildings, insulation standards, and energy compliance. These authorities ensure that renovation work aligns with national planning policies, environmental goals, and neighborhood development regulations.

Competitive Landscape

Major players in the home renovation industry are expanding into tech-driven interior design services to meet the rising consumer demand for personalization and convenience. They are integrating digital platforms with renovation offerings to streamline design consultations, material selection, and service delivery.

Players are enhancing their capabilities through strategic acquisitions to enter new verticals and capture a broader share of the residential improvement segment. Additionally, renovation and interior design firms are adopting digital tools to improve project efficiency, enhance customer experience, and scale operations more effectively.

- In June 2025, JD.com acquired Sichuan-based Life Home Furnishings Group, a leading direct-to-consumer interior design brand, as part of its strategic expansion into the market in China. The acquisition aims to integrate JD.com's digital capabilities with renovation services, offering personalized and tech-enabled interior solutions while strengthening its position in the growing home improvement sector.

Key Companies in Home Renovation Market:

- Home Depot

- Lowe's

- Masco Corporation

- Kingfisher plc

- Bunnings Group Limited

- Travis Perkins Group

- ADEO

- OBI

- Menard, Inc

- The Sherwin-Williams

- Stanley Black & Decker, Inc

- Owens Corning.

- Pella Corporation

- Andersen Windows, Inc

- Houzz Inc.

Recent Developments (Product Launch)

- In April 2025, James Hardie launched Hardie Designer, an AI-powered home exterior design tool developed in collaboration with Hover. The platform allows homeowners to upload a photo of their house and instantly visualize Hardie siding products with various profiles, textures, and colors.

- In March 2024, Kingfisher launched a new home improvement e-commerce marketplace at Castorama France to expand its digital presence and product offerings. The platform introduces over 500,000 products from verified third-party merchants, significantly increasing product variety and supporting customer demand for convenience and choice in renovation purchases.

freqAskQues