buyNow

Home Fitness Equipment Market

Home Fitness Equipment Market Size, Share, Growth & Industry Analysis, By Product Type (Cardiovascular Equipment, Strength Training Equipment, Others), By Connectivity (Smart/ Connected Equipment, Non-connected Equipment), By Pricing (Low-End/ Budget Equipment, Mid-Range Equipment), By End User, By Distribution Channel and Regional Analysis, 2025-2032

pages: 210 | baseYear: 2024 | release: July 2025 | author: Versha V.

Market Definition

Home fitness equipment includes machines and tools designed for physical exercise within residential settings. These products support various workout types, such as cardiovascular training, strength building, and flexibility improvement. Typical equipment includes treadmills, stationary bicycles, ellipticals, weights, resistance bands, and yoga mats.

Home Fitness Equipment Market Overview

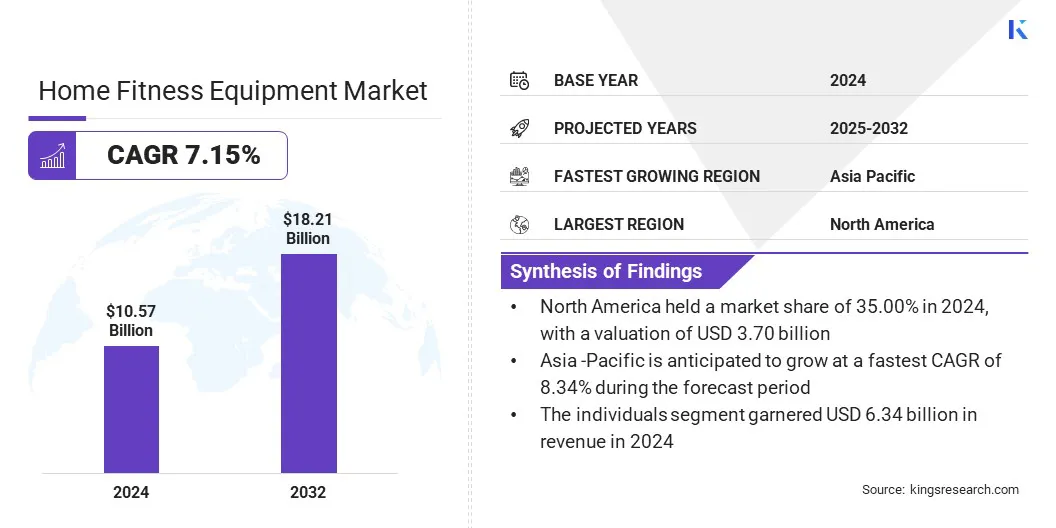

The global home fitness equipment market size was valued at USD 10.57 billion in 2024 and is projected to grow from USD 11.23 billion in 2025 to USD 18.21 billion by 2032, exhibiting a CAGR of 7.15% during the forecast period.

The market growth is attributed to the rising prevalence of obesity, which is increasing demand for convenient at-home fitness solutions. The market is further driven by smart technology integration with home fitness equipment that enables personalized and connected workout experiences.

Key Highlights:

- The home fitness equipment industry size was valued at USD 10.57 billion in 2024.

- The market is projected to grow at a CAGR of 7.15% from 2025 to 2032.

- North America held a market share of 35.00% in 2024, with a valuation of USD 3.70 billion.

- The cardiovascular equipment segment garnered USD 4.23 billion in revenue in 2024.

- The non-connected equipment segment is expected to reach USD 10.68 billion by 2032.

- The high-end/ premium equipment segment is anticipated to witness the fastest CAGR of 9.53% during the forecast period.

- The individuals segment garnered USD 6.34 billion in revenue in 2024

- The online retail held a market share of 55.00% in 2024

- Asia Pacific is anticipated to grow at a CAGR of 8.34% during the forecast period.

Major companies operating in the home fitness equipment market are Peloton, iFIT Inc., Nautilus, TECHNOGYM USA Corp, TRINITY HEALTH TECHNOLOGIES PVT. LTD., Johnson Health Tech, True Fitness, Precor Incorporated, Life Fitness, SOLE FITNESS, lululemon athletica inc, Tonal, Tempo, FightCamp, and Echelon Fit.

The growing integration of immersive gaming elements and smart connectivity is accelerating growth in the market. Companies are introducing interactive, app-connected machines that combine entertainment with exercise. This approach appeals to tech-savvy consumers looking for personalized and engaging workout experiences, thereby increasing adoption.

- In January 2025, Merach introduced a new line of smart home fitness equipment at CES 2025, featuring the NovaWalk W50, NovaBike S60 Pro, and S28 Smart Off-Road Racing Bike. The company also launched FantomFite, an immersive fitness gaming platform designed to enhance user engagement.

Market Driver

Rising Prevalence of Obesity

The rising prevalence of obesity is driving the growth of the home fitness equipment market. Growing awareness of the health risks associated with sedentary lifestyles prompts individuals to adopt regular physical activity as a preventive measure.

Home fitness equipment offers a convenient and private solution for managing weight, improving cardiovascular health, and building overall fitness. Moreover, the increasing availability of smart, space-efficient, and user-friendly machines is influencing consumers to create personalized workout spaces within their homes, in turn, accelerating market growth.

- According to 2023 data from the Centers for Disease Control and Prevention (CDC), over one in three adults (35% or more) is living with obesity in 23 U.S. states. The data also shows that in every state, at least one in five adults (20% or more) is affected by obesity.

Market Challenge

High Initial Investment Cost

A key challenge in the home fitness equipment market is the high initial investment cost required for purchasing advanced machines. Home fitness equipment featuring smart technology, digital interfaces, and real-time workout tracking is often priced at a premium, making it inaccessible for a significant segment of consumers.

This cost barrier is limiting in price-sensitive markets, where budget constraints hinder adoption of smart and connected fitness equipment. Moreover, the additional expense of subscriptions for interactive fitness content further elevates the total ownership cost, affecting long-term consumer commitment.

To address the challenge, market players are introducing more affordable, entry-level equipment with essential smart features to attract budget-conscious consumers. They are adopting buy-now-pay-later models to reduce upfront costs and make home fitness equipment more accessible to a broader range of consumers.

Additionally, players are expanding product lines to include compact, multifunctional machines that offer greater value for money to attract a wider consumer base seeking an affordable home fitness solution.

Market Trend

Integration of Smart Technology

A key trend in the home fitness equipment market is the growing integration of smart technologies such as sensors, connectivity, and AI-driven features. Consumers are increasingly opting for equipment that offers real-time performance tracking, app synchronization, and interactive coaching.

Manufacturers are increasingly integrating AI coaches, immersive displays, and adaptive resistance systems to deliver personalized workout experiences. These innovations are reshaping the home fitness environment by making workouts more engaging efficient and data-driven for consumers seeking personalized and connected exercise experiences.

- In September 2024, iFIT launched a new lineup of over 40 smart and smart-enabled fitness products under its NordicTrack and ProForm brands. The launch introduced a redesigned iFIT operating system, immersive outdoor content, and an interactive AI Coach (beta), aiming to deliver highly personalized home workout experiences.

Home Fitness Equipment Market Report Snapshot

|

Segmentation |

Details |

|

By Product Type |

Cardiovascular Equipment (Treadmills, Stationary Bikes, Elliptical, Rowing Machines, Stair Steppers/Climbers), Strength Training Equipment (Free Weights (Dumbbells, Barbells, Kettlebells), Weight Plates, Benches & Racks, Multi-gyms/Home Gyms, Resistance Bands), Smart Fitness Equipment (AI-integrated Machines, App-connected Treadmills & Bikes, Virtual Training Mirrors), Accessories (Yoga Mats, Foam Rollers, Stability Balls, Jump Ropes, Balance Boards, Others) |

|

By Connectivity |

Smart/ Connected Equipment, Non-connected Equipment |

|

By Pricing |

Low-End/ Budget Equipment, Mid-Range Equipment, High-End/ Premium Equipment |

|

By End User |

Individuals, Fitness Enthusiasts/ Athletes, Elderly |

|

By Distribution Channel |

Online Retail (Brand Websites, E-commerce Platforms), Offline Retail (Specialty Fitness Stores, Department & Sporting Goods Stores, Hypermarkets / Supermarkets) |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Product Type (Cardiovascular Equipment, Strength Training Equipment, Smart Fitness Equipment, and Accessories): The cardiovascular equipment segment earned USD 4.23 billion in 2024 due to rising demand for home-based aerobic workouts supporting heart health and weight management.

- By Connectivity (Smart/ Connected Equipment, and Non-connected Equipment): The non-connected equipment segment held 65.00% of the market in 2024, due to its affordability, ease of use, and suitability for beginners.

- By Pricing (Low-End/ Budget Equipment, Mid-Range Equipment, High-End/ Premium Equipment): The mid-range equipment segment is projected to reach USD 7.10 billion by 2032, propelled by growing demand for durable and feature-rich products at accessible prices.

- By End User (Individuals, Fitness Enthusiasts/ Athletes, Elderly): The Individuals segment earned USD 6.34 billion in 2024, owing to increasing health awareness and preference for cost-effective personal fitness setups.

- By Distribution Channel (Online Retail and Offline Retail): The online retail segment is anticipated to witness the fastest CAGR of 8.41% during the forecast period due to rising e-commerce penetration and availability of wide product choices with doorstep delivery.

Home Fitness Equipment Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America home fitness equipment market accounted for a market share of 35.00% in 2024, with a valuation of USD 3.70 billion. This dominance is attributed to the strong presence of established manufacturers and the early adoption of connected fitness technologies across the region.

The market in this region is experiencing steady growth as leading market players are introducing smart, app-integrated equipment that enables real-time performance tracking and guided workouts.

Moreover, increasing focus on preventative wellness across North America is further driving market growth. Advanced distribution networks, along with increased investments in digital fitness platforms and user engagement, are helping companies expand their reach and boost market in the region.

- In May 2025, Sunny Health & Fitness acquired UK-based JLL Fitness to expand its global presence enhance its smart home fitness capabilities. The acquisition combines complementary strengths in home and commercial equipment and supports the integration of JLL’s products with the SunnyFit app.

The Asia Pacific home fitness equipment industry is set to grow at a robust CAGR of 8.34% over the forecast period. This growth is attributed to the rising prevalence of lifestyle-related diseases and physical inactivity across the region. Individuals are increasingly adopting preventive health solutions through structured at-home fitness routines to improve overall well-being.

Consumers are prioritizing compact, multifunctional home fitness equipment that enables consistent physical activity without relying on gym memberships. Moreover, government-led wellness campaigns and the rapid expansion of digital fitness platforms across the region are promoting active living and supporting the adoption of home-based exercise solutions.

- In September 2024, the World Health Organization reported that nearly 74% of adolescents and 50% of adults in the South-East Asia Region are not sufficiently physically active. This widespread inactivity is contributing to a rise in noncommunicable diseases, including cardiovascular disease and diabetes.

Regulatory Frameworks

- In the U.S., the Consumer Product Safety Commission (CPSC) oversees the safety of home fitness equipment by enforcing standards related to mechanical integrity, electrical safety, and labeling. The CPSC monitors injury risks, mandates product recalls when necessary, and ensures compliance with federal safety regulations to protect consumers from defective or hazardous equipment.

- In China, the State Administration for Market Regulation (SAMR) regulates home fitness equipment by setting national product safety standards and ensuring compliance through inspections and certifications.

- In India, the Bureau of Indian Standards (BIS) regulates home fitness equipment by developing and enforcing quality and safety standards under the BIS Act. It ensures products meet mechanical and material specifications, mandates proper labeling, and grants ISI certification to compliant products, promoting safe usage and protecting consumer interests.

- In the UK, the Office for Product Safety and Standards (OPSS) oversees the regulation of home fitness equipment by enforcing compliance with product safety laws under the General Product Safety Regulations. OPSS conducts market surveillance, evaluates product risks, and implements corrective actions such as recalls, ensuring that equipment sold to consumers is safe and reliable.

Competitive Landscape

Major players in the home fitness equipment industry are expanding their offerings alongside hardware by integrating digital fitness platforms to meet evolving consumer preferences. Companies are launching virtual fitness studios and offering interactive classes to boost user engagement and provide more comprehensive, at-home workout experiences.

These initiatives combine real-time instruction, progress tracking, and community features to create a more immersive and motivating environment for users. Additionally, market players are focusing on building connected ecosystems that combine premium equipment with interactive, instructor-led sessions.

- In September 2024, Sole Fitness expanded its virtual fitness space with the launch of Sole+ Studios. The company is introducing streamable workout classes across its best-selling equipment to meet rising demand for guided at-home fitness experiences. This expansion aims to deliver integrated fitness solutions by combining premium hardware with engaging digital content.

Key Companies in Home Fitness Equipment Market:

- Peloton

- iFIT Inc.

- Nautilus

- TECHNOGYM USA Corp

- TRINITY HEALTH TECHNOLOGIES PVT. LTD

- Johnson Health Tech

- True Fitness

- Precor Incorporated

- Life Fitness

- SOLE FITNESS

- lululemon athletica inc

- Tonal

- Tempo

- FightCamp

- Echelon Fit

Recent Developments (Partnerships/ Product Launch)

- In July 2025, RITFIT launched its first-ever physical showroom in Chino Hills, California, marking a shift from e-commerce to an omnichannel retail model. The showroom offers hands-on equipment trials, expert guidance, and exclusive in-store promotions to enhance customer experience.

- In March 2025, Echelon Fitness partnered with Amazon Web Services to launch Echelon Intelligence, a generative AI-powered platform delivering personalized workout experiences across its connected equipment. The integration enhances user engagement through adaptive plans, real-time tracking, and intelligent class recommendations.

- In December 2024, Sunny Health & Fitness introduced the Sunny Strength Line, expanding its product portfolio from cardio equipment into strength training. The new collection includes racks, benches, smith machines, free weights, and accessories designed to combine performance with modern aesthetics.

freqAskQues