buyNow

Ethylene Vinyl Acetate Market

Ethylene Vinyl Acetate Market Size, Share, Growth & Industry Analysis, By Grade (Low VA Content (<10% VA), Medium VA Content (10% - 20% VA), High VA Content (>20% VA)), By End Use, and Regional Analysis, 2025-2032

pages: 140 | baseYear: 2024 | release: July 2025 | author: Versha V.

Market Definition

Ethylene vinyl acetate, a copolymer of ethylene and vinyl acetate, is known for its flexibility, clarity, and resistance to cracking and UV radiation. It is widely used across several industries due to its versatile mechanical and chemical properties. The material offers excellent impact resistance, stress-crack resistance, and low-temperature toughness, making it suitable for both rigid and flexible applications.

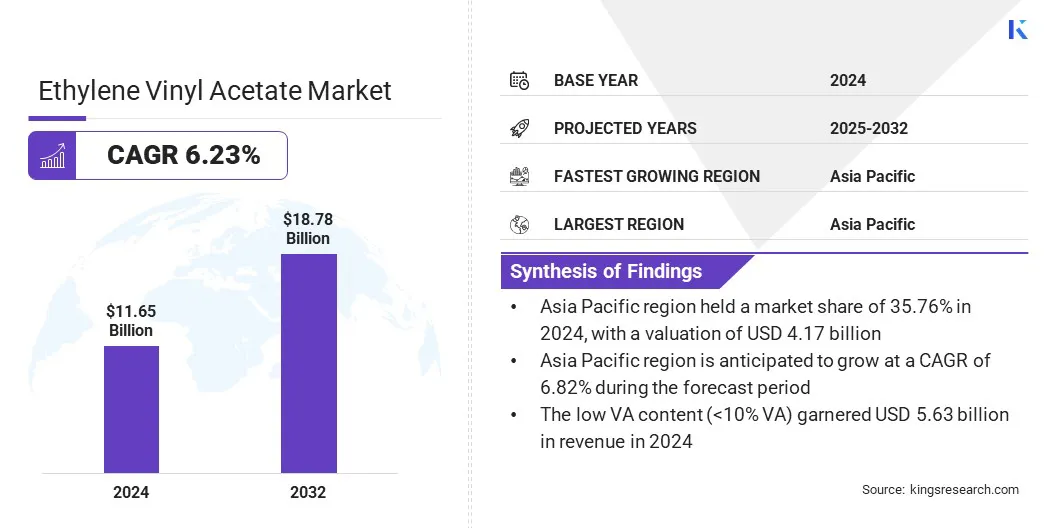

The global ethylene vinyl acetate market size was valued at USD 11.65 billion in 2024 and is projected to grow from USD 12.30 billion in 2025 to USD 18.78 billion by 2032, exhibiting a CAGR of 6.23% during the forecast period.

This growth is fueled by the growing demand for ethylene vinyl acetate in medical applications such as drug delivery systems, transdermal patches, and flexible medical packaging. The shift toward renewables-based production is also influencing material selection, as manufacturers explore sustainable alternatives to conventional petrochemical-derived grades.

Key Highlights:

- The ethylene vinyl acetate industry size was recorded at USD 11.65 billion in 2024.

- The market is projected to grow at a CAGR of 6.23% from 2025 to 2032.

- Asia Pacific held a share of 35.76% in 2024, valued at USD 4.17 billion.

- The low VA content (<10% VA) segment garnered USD 5.63 billion in revenue in 2024.

- The photovoltaic (PV) panels / solar cell encapsulation segment is expected to reach USD 6.57 billion by 2032.

- Europe is anticipated to grow at a CAGR of 6.58% over the forecast period.

Major companies operating in the ethylene vinyl acetate market are Exxon Mobil Corporation, KURARAY, Celanese Corporation, Westlake Corporation, LyondellBasell Industries Holdings B.V., Arkema, TotalEnergies, Hanwha Solutions Chemical Division, Borealis GmbH, TPI Polene Public Company Limited, Armacell GmbH, Braskem, LG Chem., SABIC, and Dow.

Ethylene Vinyl Acetate Market Report Scope

|

Segmentation |

Details |

|

By Grade |

Low VA Content (<10% VA), Medium VA Content (10% - 20% VA), High VA Content (>20% VA) |

|

By End Use |

Footwear & Foams, Photovoltaic (PV) Panels / Solar Cell Encapsulation, Packaging, Automotive, Healthcare and Medical, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Ethylene Vinyl Acetate Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific ethylene vinyl acetate market share stood at 35.76% in 2024, valued at USD 4.17 billion. This dominance is reinforced by continuous innovation across manufacturing and material applications.

Regional producers in countries such as China, India, South Korea, and Japan have enhanced product performance through new formulations and process improvements. These innovations support large-scale production for footwear, packaging, and industrial uses. Strong domestic demand and export-oriented output have positioned Asia Pacific as the leading market for ethylene vinyl acetate.

- In November 2024, Dow launched ELVAX EVA REN, a bio-circular ethylene vinyl acetate solution developed to support sustainability in footwear manufacturing. The material is produced using alternative feedstocks derived from waste residues or by-products, reducing reliance on fossil-based inputs.

The Europe ethylene vinyl acetate industry is poised to grow at a significant CAGR of 6.58% over the forecast period. This growth is propelled by the region’s strong focus on sustainable materials and regulatory compliance.

Countries such as Germany, France, and Italy are increasing the use of ethylene vinyl acetate in automotive, packaging, and consumer goods. Manufacturers are shifting toward non-toxic, recyclable polymers to meet the European Union’s environmental and chemical safety standards, supporting regional market expansion.

Ethylene Vinyl Acetate Market Overview

Market expansion is propelled by technological advancements in the production of ethylene vinyl acetate resins. Manufacturers are adopting high-pressure autoclave and tubular reactor technologies to improve product uniformity and achieve precise control over vinyl acetate content.

High pressure PE process technology enables the production of high-quality copolymers with tailored properties. This process ensures better dispersion of vinyl acetate in the polymer matrix, resulting in improved flexibility, adhesion, and clarity. It also supports greater process stability and scalability for diverse end-use requirements.

- In June 2024, Univation Technologies, LLC introduced the UNIGILITY Tubular High Pressure PE Process as a licensed manufacturing platform for producing low-density polyethylene and ethylene vinyl acetate resins. It supports various ethylene vinyl acetate applications across industrial and food packaging, including greenhouse films, footwear components, photovoltaics, and flexible hosing.

Market Driver

Growing Demand for Ethylene Vinyl Acetate

The growth of the ethylene vinyl acetate market is propelled by increasing use in healthcare applications such as sustained dose release and transdermal drug delivery. Ethylene vinyl acetate provides biocompatibility, flexibility, and controlled release, which are essential for modern pharmaceutical systems.

It enables consistent drug delivery over time, improving treatment effectiveness and patient adherence. Pharmaceutical companies are adopting ethylene vinyl acetate to develop advanced drug delivery products, boosting market growth.

- In February 2024, Celanese Corporation announced the commercial launch of iDose TR by Glaukos Corporation, featuring its VitalDose platform. This technology enables sustained drug release via a nanoporous membrane, offering an alternative to topical glaucoma treatments and addressing patient non-compliance.

Market Challenge

Volatile Raw Material Prices Impacting Ethylene Vinyl Acetate Production

A major challenge impeding the expansion of the ethylene vinyl acetate market is the fluctuation in prices of core raw materials such as ethylene and vinyl acetate monomer. These inputs are derived from petrochemicals, making their prices sensitive to global crude oil trends and supply chain disruptions.

Frequent cost changes create difficulties in maintaining stable production expenses and consistent pricing for end-use industries. This affects planning and reduces profit margins for manufacturers.

To mitigate this challenge, companies are entering long-term supply contracts and increasing local sourcing. They are also improving process efficiency to minimize the impact of cost fluctuations.

Market Trend

Shift Toward Renewables-Based Production

The ethylene vinyl acetate market is witnessing a growing shift toward renewables-based production. Manufacturers are increasingly exploring bio-based feedstocks to reduce dependence on fossil fuels and lower carbon emissions.

This trend aligns with global sustainability goals and regulatory pressure to adopt environmentally responsible materials. Renewables-based ethylene vinyl acetate offers comparable performance while supporting circular economy initiatives. Producers are investing in green chemistry and process innovations to commercialize sustainable variants and meet evolving customer preferences across industries.

- In May 2025, Borealis launched a renewables-based ethylene vinyl acetate grade developed specifically for footwear midsole applications. The new material, part of the Bornewables portfolio, is made from renewable feedstocks sourced from waste and residue streams. It offers virgin-quality performance while reducing the carbon footprint by 45% compared to fossil-based equivalents.

Market Segmentation

- By Grade (Low VA Content (<10% VA), Medium VA Content (10% - 20% VA), High VA Content (>20% VA)): The low VA content (<10% VA) segment earned USD 5.63 billion in 2024, mainly due to its widespread use in wire and cable insulation, hot melt adhesives, and extrusion coatings.

- By End Use (Footwear & Foams, Photovoltaic (PV) Panels / Solar Cell Encapsulation, Packaging, and Automotive): The photovoltaic (PV) panels / solar cell encapsulation segment held a share of 30.94% in 2024, fueled by rising solar energy installations and growing demand for EVA-based encapsulants.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates EVA under 21 CFR §177.1350 for use in food-contact applications. It sets specific migration limits and conditions of use for EVA copolymers in packaging materials.

- In Europe, ethylene vinyl acetate is governed under Regulation (EU) No 10/2011 on plastic materials and articles intended for food contact. The regulation lists authorized monomers and additives, including vinyl acetate, and sets migration limits to ensure consumer safety.

Competitive Landscape

Key players in the global ethylene vinyl acetate industry are focusing on strategic collaborations to strengthen their market presence and enhance production capabilities. Companies are forming joint ventures with regional manufacturers to expand their geographic footprint and secure reliable access to raw materials. These collaborations support technology sharing, reduce operational risks, and enable faster adaptation to regulatory changes in key markets.

Market participants are also partnering with research institutions and material science firms to develop advanced formulations and sustainable product variants. Through such alliances, companies aim to accelerate innovation, improve cost efficiency, and respond effectively to evolving customer requirements across diverse end-use sectors.

- In May 2024, Lummus Technology and Sumitomo Chemical entered into two collaboration agreements to license and commercialize proprietary technologies, including Sumitomo Chemical’s low-density polyethylene/ethylene vinyl acetate production technology. Under the agreements, Lummus will serve as the exclusive global licensor, leveraging its marketing reach and engineering capabilities to deliver these technologies globally.

List of Key Companies in Ethylene Vinyl Acetate Market:

- Exxon Mobil Corporation

- KURARAY

- Celanese Corporation

- Westlake Corporation

- LyondellBasell Industries Holdings B.V.

- Arkema

- TotalEnergies

- Hanwha Solutions Chemical Division

- Borealis GmbH

- TPI Polene Public Company Limited

- Armacell GmbH

- Braskem

- LG Chem.

- SABIC

- Dow

Recent Developments (Product Launch)

- In September 2024, Dow-Mitsui Polychemicals Company, Ltd. launched biomass-based ethylene vinyl acetate and low-density polyethylene produced using the mass balance method. These products match the performance of petroleum-based materials, enabling direct substitution and lowering greenhouse gas emissions.

freqAskQues