enquireNow

Citric Acid Market

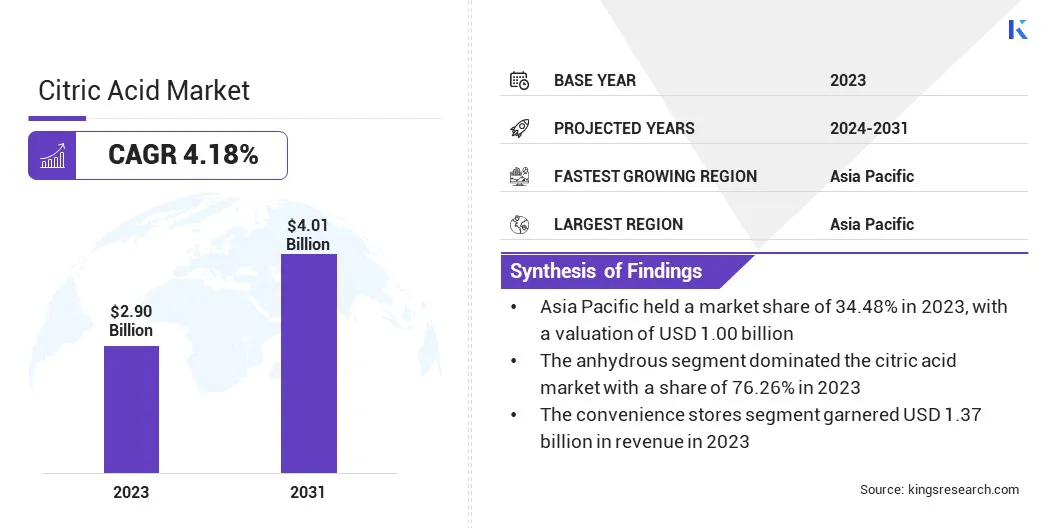

Citric Acid Market Size, Share, Growth & Industry Analysis, By Form (Liquid, Anhydrous), By Application (Food & Beverages, Household Detergents, Personal Care, Pharmaceutical, Others), By Distribution Channel (Supermarket/Hypermarket, Convenience Stores, Online) and Regional Analysis, 2024-2031

pages: 120 | baseYear: 2023 | release: February 2024 | author: Antriksh P.

Citric Acid Market Size

The global Citric Acid Market size was valued at USD 2.90 billion in 2023 and is projected to reach USD 4.01 billion by 2031, growing at a CAGR of 4.18% from 2024 to 2031. In the scope of work, the report includes products offered by companies such as Cargill, Incorporated, Jungbunzlauer Suisse AG, Merck KGaA, Gadot Biochemical Industries Ltd., Foodchem International Corporation, Tate & Lyle, Hawkins, SLB, ADM, COFCO and Others.

The global market is currently experiencing robust growth with a positive outlook for the forecast years. With its versatile applications, citric acid has become a vital component in various industries. The food and beverage sector remains a major contributor, driven by the increasing demand for processed foods and consumer preferences for natural ingredients.

Furthermore, the pharmaceutical and cosmetics industries play a pivotal role in fueling market expansion. As awareness of health and wellness grows, the demand for citric acid is expected to rise, given its natural and organic attributes. The global market dynamics, influenced by key producers such as China, the United States, and Europe, are contributing to a well-established supply chain. Ongoing research and development efforts are likely to facilitate technological advancements, shaping the future of the citric acid market.

Analyst’s Review

Several key growth-influencing trends are shaping the development of the citric acid market. The increasing demand for processed foods is a significant trend, driven by changing consumer lifestyles and preferences. The rise in health awareness is pushing the demand for natural ingredients, which is positioning citric acid favorably. The pharmaceutical and cosmetics industries are witnessing substantial growth and creating additional avenues for citric acid applications.

Moreover, the market is expected to maintain a positive outlook for the forecast years, with a growing focus on sustainable production methods and exploring new applications. Technological advancements and a global supply chain are likely to aid market progress, thus making citric acid a crucial ingredient across various sectors.

Market Definition

Citric acid, a weak organic acid, is naturally found in citrus fruits. Widely recognized for its versatile properties, citric acid has become a staple in various industries. In the food & beverage sector, it serves as a preservative and flavor enhancer, finding applications in soft drinks, candies, and processed foods.

The pharmaceutical industry utilizes citric acid for its buffering and chelating properties, which are beneficial in the preparation of effervescent tablets. Additionally, citric acid is prevalent in the cosmetics and personal care industry, contributing to products as an exfoliant and pH adjuster. Its role as a cleaning and chelating agent further extends to the manufacturing of detergents. The diverse applications of citric acid underscore its importance in modern manufacturing processes.

Citric Acid Market Dynamics

The personal care industry is experiencing growing demand for tablets, particularly in formulations such as effervescent tablets. This trend is driven by the convenience and portability offered by tablets, providing consumers with an easy and controlled way to use personal care products. Tablets in the personal care sector often contain citric acid, leveraging its properties as a chelating agent and pH adjuster.

The demand for tablets aligns with consumer preferences for on-the-go products and innovative formulations, influencing manufacturers to incorporate citric acid into tablet-based personal care items. This growing trend is expected to contribute significantly to the market's expansion within the personal care industry.

One notable restraint in the citric acid market is the possibility of price fluctuations. The prices of citric acid can be subject to various external factors, including raw material costs, geopolitical events, and supply-demand dynamics. Such fluctuations pose challenges for both producers and consumers in the market. Manufacturers may face uncertainties in production costs, affecting profit margins and strategic planning.

On the consumer side, industries relying on citric acid may experience challenges in budgeting and pricing strategies due to the unpredictability of prices. Managing these fluctuations requires industry players to adopt agile strategies and closely monitor market trends, emphasizing the need for stability and resilience in the face of external economic and geopolitical influences.

Segmentation Analysis

The global market is segmented based on form, application, distribution channel, and geography.

By Form

Based on form, the market is segmented into liquid and anhydrous. The anhydrous segment dominated the citric acid market with a share of 76.26% in 2023 owing to its unique characteristics. Anhydrous citric acid is the dehydrated form, and it is preferred in various applications where water content needs to be minimized. This form of citric acid offers advantages in terms of stability and storage, making it suitable for industries such as pharmaceuticals and certain food applications. Its dominance reflects the diverse needs of end-users, driving the demand for anhydrous citric acid across different sectors. As industries continue to seek efficient and stable ingredients, the anhydrous segment is expected to maintain its prominence in the market.

By Application

Based on application, the market is classified into food & beverages, household detergents, personal care, pharmaceutical, and others. The food and beverages segment is expected to witness the fastest growth, depicting a CAGR of 4.90% over the forecast period, owing to evolving consumer preferences and industry dynamics. With the global trend toward natural and organic products, the demand for citric acid as a natural acidulant and preservative in the food and beverage sector is on the rise. The versatility of citric acid in enhancing flavors and extending shelf life positions it as a crucial ingredient in various food and beverage applications.

As consumer awareness regarding healthy and natural choices increases, the food and beverages segment is anticipated to drive the overall growth of the market, creating opportunities for manufacturers and suppliers to cater to the evolving needs of the industry.

By Distribution Channel

Based on distribution channel, the market is classified into supermarket/hypermarket, convenience stores, and online. The convenience stores segment garnered the highest valuation of USD 1.37 billion in 2023, mainly attributed to the changing retail landscape and consumer shopping behaviors. Convenience stores offer a diverse range of products, including packaged foods, beverages, and household items, where citric acid is prominently featured. The convenience of one-stop shopping, coupled with the availability of a wide variety of products, makes convenience stores key distribution channels for citric acid-based products. The strategic placement of citric acid-containing goods in these retail outlets contributes to the segment's high valuation.

As consumer preferences continue to favor convenience and variety, convenience stores are likely to maintain their position as crucial contributors to the citric acid market's revenue.

Citric Acid Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Asia Pacific Citric Acid Market share stood around 34.48% in 2023 in the global market, with a valuation of USD 1.00 billion. This dominance can be attributed to the thriving food and beverage industry, particularly in countries such as China and India, where the demand for processed and convenience foods is increasing rapidly.

Additionally, the pharmaceutical and cosmetic sectors in the region contribute to the substantial consumption of citric acid. The robust industrialization, economic growth, and changing consumer preferences in the Asia Pacific create a favorable environment for the market. As the region continues to experience technological advancements and an expanding middle-class population, the demand for citric acid is expected to remain strong, thereby solidifying Asia Pacific's position as a leading region in the global market.

Competitive Landscape

The citric acid market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Expansion & investments are the major strategic initiatives adopted by companies in this sector. Industry players are investing extensively in R&D activities, building new manufacturing facilities, and supply chain optimization.

List of Key Companies in Citric Acid Market

- Cargill, Incorporated

- Jungbunzlauer Suisse AG

- Merck KGaA

- Gadot Biochemical Industries Ltd.

- Foodchem International Corporation

- Tate & Lyle

- Hawkins

- SLB

- ADM

- SHANDONG ENSIGN INDUSTRY CO., LTD.

- COFCO

Key Industry Development

- June 2022 (Launch): Jungbunzlauer introduced zinc gluconate and monomagnesium citrate, two new mineral salts derived from high-quality sources. Monomagnesium citrate, classified within its special salts product group, is a partially neutralized magnesium salt derived from citric acid.

The global Citric Acid Market is segmented as:

By Form

- Liquid

- Anhydrous

By Application

- Food & Beverages

- Household Detergents

- Personal Care

- Pharmaceutical

- Others

By Distribution Channel

- Supermarket/Hypermarket

- Convenience Stores

- Online

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America.

freqAskQues