buyNow

Aromatherapy Diffuser Market

Aromatherapy Diffuser Market Size, Share, Growth & Industry Analysis, By Product Type (Ultrasonic diffusers, Nebulizing diffusers, Evaporative and Heat diffusers), By Application (Residential, Commercial, Spa & Relaxation, Healthcare & Offices), By Distribution Channel (Business to Business, Business to Consumer), and Regional Analysis, 2025-2032

pages: 170 | baseYear: 2024 | release: July 2025 | author: Versha V.

Market Definition

An aromatherapy diffuser is an electronic or manual device designed to disperse essential oils into the air for therapeutic inhalation. These diffusers break down essential oils into smaller molecules and distribute them into the surrounding environment, creating a calming or invigorating atmosphere based on the oil used.

Commonly used in homes, spas, yoga studios, and wellness centers, it aids in relaxation, stress relief, mood enhancement, better sleep, and respiratory support.

Aromatherapy Diffuser Market Overview

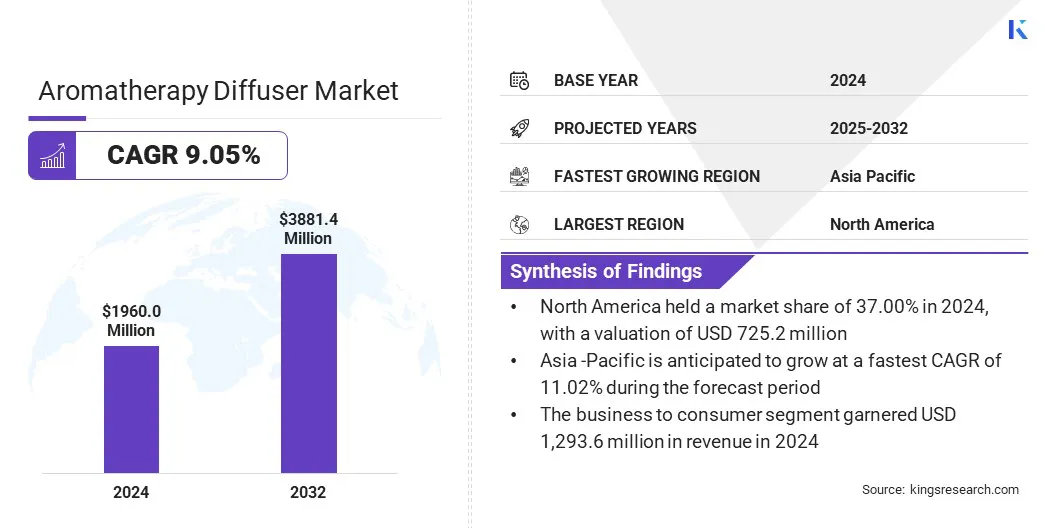

The global aromatherapy diffuser market size was valued at USD 1,960.0 million in 2024 and is projected to grow from USD 2,116.5 million in 2025 to USD 3,881.4 million by 2032, exhibiting a CAGR of 9.05% during the forecast period.

Market growth is attributed to rising consumer spending on wellness and self-care, which is creating a strong demand for products that support relaxation, mood enhancement, and holistic health. This expansion is further driven by the integration of aromatherapy diffusers into smart home ecosystems, offering users greater convenience, personalization, and connected living experiences.

Key Highlights:

- The aromatherapy diffuser industry size was valued at USD 1,960.0 million in 2024.

- The market is projected to grow at a CAGR of 9.05% from 2025 to 2032.

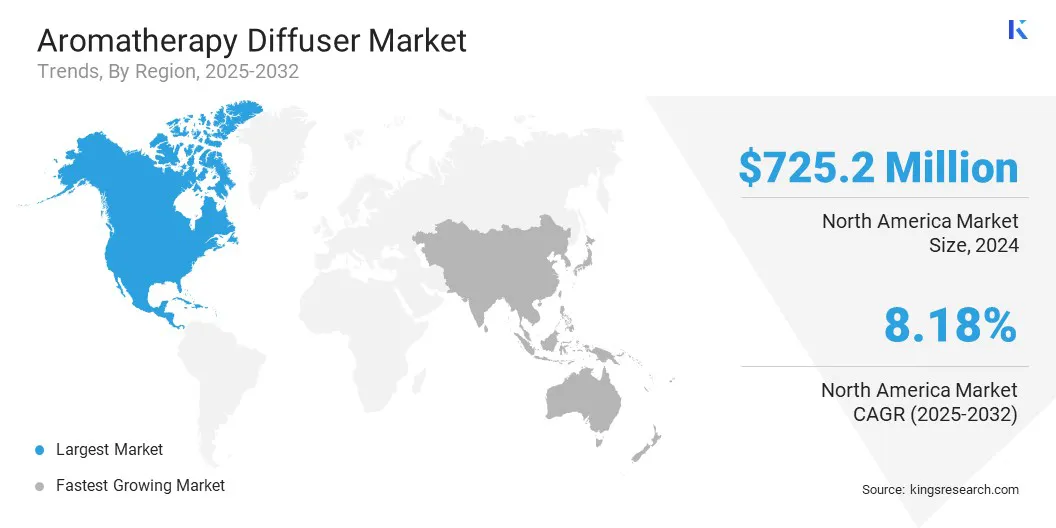

- North America held a share of 37.00% in 2024, valued at USD 725.2 million.

- The ultrasonic diffusers segment garnered USD 1,136.8 million in revenue in 2024.

- The residential segment is expected to reach USD 2,451.5 million by 2032.

- The business to consumer segment is anticipated to witness the fastest CAGR of 9.51% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 11.02% through the projection period.

Major companies operating in the aromatherapy diffuser market are Young Living Essential Oils, LC, dōTERRA, VictSing, InnoGear, NOW Foods, Saje Natural Business, Ellia.com, MUJI INDIA, ZAQ, Artnaturals-store, Stadler Form, Anjou.com, Bear Down Brands, LLC, Homedics.com, and GUANGZHOU SCENT-E SCENT TECHNOLOGY CO., LTD.

The increasing number of spas offering aromatherapy treatments is boosting the demand for diffusers that create calming and therapeutic environments. Moreover, the rising popularity of home spa routines and the growing availability of diffusers across retail and e-commerce channels are accelerating market growth.

- As of 2023, the Global Wellness Institute (GWI) estimates that there are 191,348 spas worldwide, generating approximately USD 137 billion in revenue.

Market Driver

Increasing Consumer Spending on Wellness

The increasing consumer spending on wellness and self-care is propelling the growth of the aromatherapy diffuser market. Rising awareness of mental health, relaxation, and holistic healing is prompting individuals to incorporate aromatherapy into their daily routines.

Aromatherapy diffusers offer therapeutic benefits such as stress relief, improved sleep, and mood enhancement, making them an essential part of modern wellness practices. Moreover, the growing availability of these products across online platforms and wellness-focused retail stores is further accelerating market expansion.

- The global wellness economy is projected to grow at a CAGR of 7.3% from 2023 to 2028, reaching nearly USD 6.8 trillion in 2024. This reflects a strong shift toward holistic health and self-care practices, propelled by rising consumer demand for wellness-focused products and services.

Market Challenge

Lack of Standardization and Quality Control

A key challenge hindering the expansion of the aromatherapy diffuser market is the lack of standardization and quality control across products and essential oils. Inconsistent manufacturing practices result in varying performance, durability, and safety, making it difficult for consumers to trust product claims.

Additionally, the absence of regulatory oversight on essential oil purity can lead to the use of synthetic or adulterated oils, potentially causing allergic reactions or health concerns. This inconsistency undermines consumer confidence and impedes market expansion among health-conscious buyers.

To overcome this challenge, market players are focusing on enhancing product transparency and adopting standardized manufacturing practices to ensure consistent quality. Leading brands are partnering with certified essential oil suppliers and implementing rigorous testing protocols to verify oil purity and diffuser safety.

Clear labeling, user education, and compliance with international safety standards are being prioritized to build consumer trust. Additionally, third-party certifications and quality assurance are leveraged to attract health-conscious and safety-focused customers.

Market Trend

Integration of Aromatherapy Diffusers into Smart Home Ecosystems

A key trend influencing the aromatherapy diffuser market is the rising adoption of smart and app-enabled diffusers. Consumers are increasingly seeking connected devices that offer personalized control, scheduling, and automation through mobile applications and smart home platforms such as HyperOS, Alexa, and Google Home.

This trend is prompting manufacturers to integrate features such as motion sensing, ambient lighting, and adjustable scent levels to enhance user experience. These innovations are expanding diffusers application from wellness to lifestyle and home automation, boosting adoption across residential and commercial segments.

- In October 2024, Xiaomi launched the Mijia Smart Aroma Diffuser Set in China at a price of USD 20. The device features smart fragrance control, motion sensing, and ambient lighting with 16 million color options, and a 50-day battery life. It integrates with HyperOS via the Mijia App, enabling customizable scent levels and automated controls.

Aromatherapy Diffuser Market Report Snapshot

|

Segmentation |

Details |

|

By Product Type |

Ultrasonic diffusers, Nebulizing diffusers, Evaporative and Heat diffusers |

|

By Application |

Residential, Commercial, Spa & Relaxation, Healthcare & Offices |

|

By Distribution Channel |

Business to Business, Business to Consumer (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail Stores, Others) |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Product Type (Ultrasonic diffusers, Nebulizing diffusers, and Evaporative and Heat diffusers): The ultrasonic diffusers segment earned USD 1,136.8 Million in 2024, mainly due to their affordability, quiet operation, and compatibility with essential oils for everyday home use.

- By Application (Residential, Commercial, Spa & Relaxation, and Healthcare & Offices): The residential segment held a share of 62.00% in 2024, fueled by increasing consumer preference for home wellness solutions and easy-to-use personal aromatherapy devices.

- By Distribution Channel (Business to Business and Business to Consumer): The business to consumer segment is projected to reach USD 2,641.7 million by 2032, owing to the rapid expansion of e-commerce platforms and rising direct-to-consumer wellness product adoption.

Aromatherapy Diffuser Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America aromatherapy diffuser market accounted for a share of 37.00% in 2024, valued at USD 725.2 million. This dominance is attributed to the growing consumer inclination toward chemical-free lifestyle products.

There is a rising demand for natural wellness solutions that avoid synthetic ingredients and support holistic health. Consumers in the region are adopting eco-friendly diffusers that support relaxation and emotional balance, which is aiding regional market expansion.

Moreover, the regional market is benefiting from increasing awareness of indoor air quality and the preference for portable, cordless devices that offer scent delivery without relying on artificial elements. Brands in the region are launching products that emphasize personalized well-being and clean fragrance application, which is supporting regional market expansion.

- In May 2025, Aroma Amplifier launched an eco-friendly, cordless aromatherapy diffuser designed to promote natural, toxin-free home wellness. The product addresses sensory overload caused by synthetic scents, offering a chemical-free solution to support focus and calm. Key features include portability, a minimalist design, and clean fragrance delivery for enhanced emotional well-being.

The Asia Pacific aromatherapy diffuser industry is set to grow at a robust CAGR of 11.02% over the forecast period. This growth is propelled by the rising prevalence of mental health conditions, which is creating a demand for natural and non-invasive wellness solutions.

The regional market is witnessing increased consumer interest in aromatherapy to manage stress, anxiety, and sleep-related issues through essential oil diffusion. Consumers are adopting diffusers as part of their self-care routines to seek emotional balance and mental clarity in daily life.

Moreover, the growing health awareness and concerns over indoor air quality in densely populated areas are supporting regional market growth. Brands in the region are launching affordable and portable aromatherapy diffusers tailored to local wellness preferences, which is further supporting this expansion.

- As of 2023, the World Health Organization reported that approximately 260 million individuals in the Southeast Asia Region were affected by mental health conditions.

Regulatory Frameworks

- In the U.S, the Food and Drug Administration (FDA) regulates aromatherapy products when essential oils or diffusers are marketed with therapeutic or medical claims. The FDA oversees labeling, ingredient safety, and advertising to prevent consumer misinformation.

- In China, the National Medical Products Administration (NMPA) monitors aromatherapy diffusers and essential oils promoted for therapeutic, health, or wellness benefits. The NMPA ensures that products meet national safety, efficacy, and labeling standards. The NMPA also oversees quality control, production practices, and compliance with hygiene and import regulations, particularly for imported essential oils and high-end electric diffuser systems used in wellness or medical environments.

- In India, the Central Drugs Standard Control Organization (CDSCO) regulates aromatherapy diffusers and essential oils marketed under medicinal or therapeutic categories.

- In the U.K., the Medicines and Healthcare Products Regulatory Agency (MHRA) regulates aromatherapy diffusers and essential oils marketed with therapeutic claims, such as treating anxiety, insomnia, or respiratory issues.

Competitive Landscape

Major players operating in the aromatherapy diffuser industry are focusing on enhancing user experience by integrating scent as a core element of spatial branding. They are collaborating with hospitality providers to install electric diffusers in communal and private spaces. Market participants are adopting premium scent solutions to differentiate offerings, increase customer engagement, and align with lifestyle-focused environments.

- In November 2024, Hone Aroma partnered with Dubai-based hotel Nas House to integrate luxury electric diffusers and pure aroma oil blends in its villas and communal areas. The collaboration reflects the growing adoption of scent-based branding in the hospitality sector to elevate guest experience.

Key Companies in Aromatherapy Diffuser Market:

- Young Living Essential Oils, LC

- dōTERRA

- VictSing

- InnoGear

- NOW Foods

- Saje Natural Business

- Ellia.com

- MUJI INDIA.

- ZAQ

- Artnaturals-store

- Stadler Form

- Anjou.com

- Bear Down Brands, LLC

- Greenai

- GUANGZHOU SCENT-E SCENT TECHNOLOGY CO., LTD

Recent Developments (Product Launch)

- In April 2024, AERON Lifestyle Technology, Inc. launched a new tabletop diffuser under its Belle Aroma brand, featuring resistor heating technology that eliminates the need for a lightbulb. The innovation reduces energy use by 40% and enhances product lifespan.

freqAskQues