Market Definition

The market focuses on the production and distribution of cellulose acetate, a semi-synthetic compound derived from cellulose, typically sourced from wood pulp or cotton linters and treated with acetic acid, acetic anhydride, and sulfuric acid.

It is commonly used in cigarette filters, textiles, eyewear frames, and films. The report highlights key market drivers, major trends, regulatory frameworks, and the competitive landscape shaping the industry’s growth.

Cellulose Acetate Market Overview

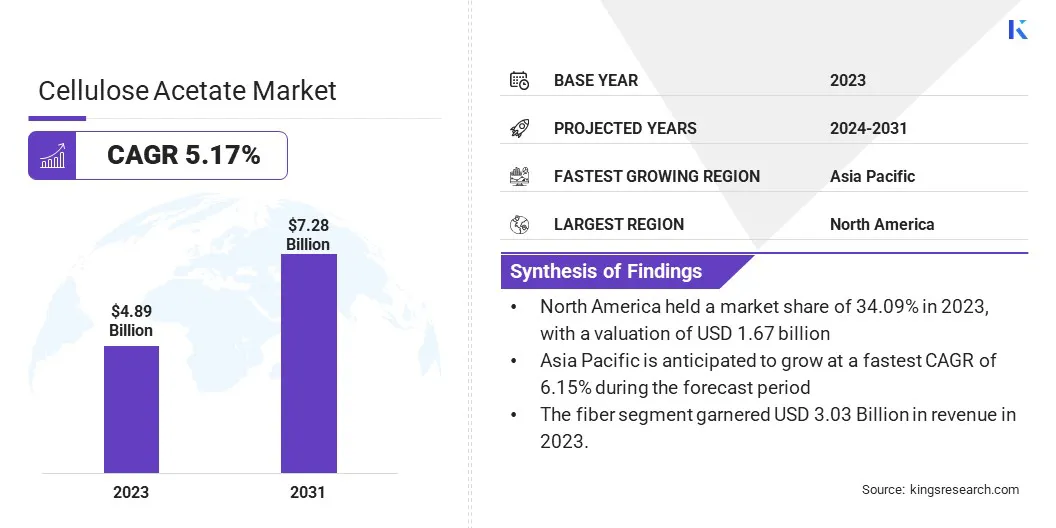

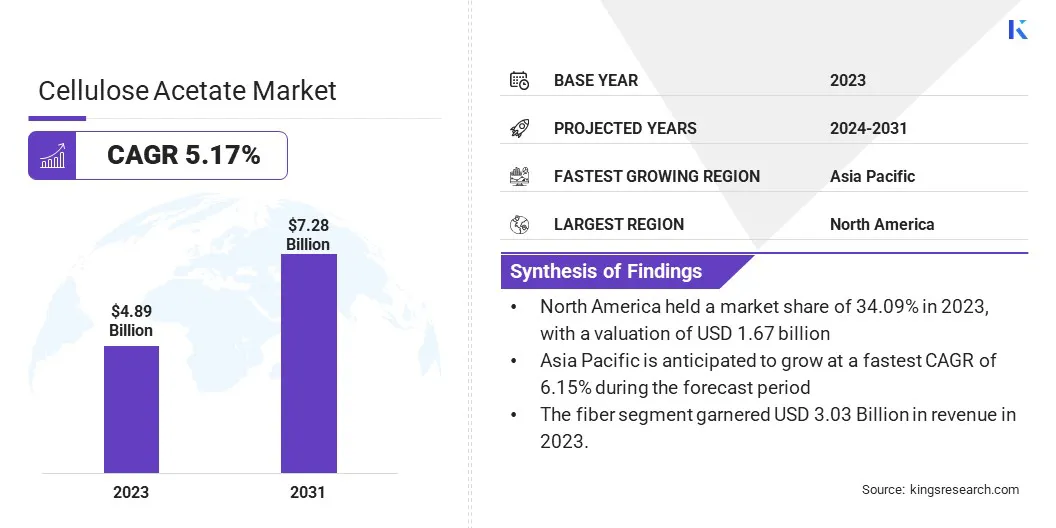

The global cellulose acetate market size was valued at USD 4.89 billion in 2023 and is projected to grow from USD 5.11 billion in 2024 to USD 7.28 billion by 2031, exhibiting a CAGR of 5.17% during the forecast period.

Market growth is primarily driven by increasing demand for eco-friendly and biodegradable materials across various end-use industries, including textiles, pharmaceuticals, packaging, and consumer goods.

Cellulose acetate, derived from natural cellulose sources such as wood pulp and cotton linters, is widely used for its excellent film-forming, chemical resistance, and thermoplastic properties. Growing environmental awareness and regulatory shift toward reducing plastic pollution are prompting manufacturers to adopt sustainable alternatives such as cellulose acetate.

Major companies operating in the cellulose acetate industry are Daicel Corporation, Eastman Chemical Company, Celanese Corporation, Borregaard AS, Rayonier Advanced Materials, Rotuba, Inc., A. B. Enterprises, Grafix Plastics, Haihang Industry, Cerdia International GmbH, SK Chemicals, Merck KGaA, and Sichuan Push Acetati Co. Ltd.

Rising consumer awareness of plastic pollution is prompting industries to adopt biodegradable alternatives such as cellulose acetate. Its plant-based origin and biodegradability make it a preferred choice in textiles, packaging, and consumer goods. This shift in consumer preference is creating steady demand and boosting market expansion.

- According to European Bioplastics, global bioplastics production capacity is expected to grow significantly from approximately 2.47 million tonnes in 2024 to around 5.73 million tonnes by 2029.

Key Highlights:

- The cellulose acetate industry size was recorded at USD 4.89 billion in 2023.

- The market is projected to grow at a CAGR of 5.17% from 2024 to 2031.

- North America held a market share of 34.09% in 2023, with a valuation of USD 1.67 billion.

- The fiber segment garnered USD 3.03 billion in revenue in 2023.

- The cigarette filters segment is expected to reach USD 1.91 billion by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 6.15% over the forecast period.

Market Driver

"Growth of the Textile Industry"

The notable expansion of the textile industry is contributing significantly to the growth of the cellulose acetate market, particularly in the production of fibers and fabrics. Cellulose acetate is valued in the textile sector for its silk-like appearance, smooth texture, and excellent drape, making it a preferred choice for garments, linings, and home furnishings.

Cellulose acetate fibers are biodegradable and derived from renewable sources such as wood pulp and cotton linters, aligning with the growing consumer shift toward sustainable and eco-friendly fashion.

As brands and manufacturers aim to reduce their environmental footprint, many are turning to semi-synthetic fibers such as cellulose acetate as alternatives to petroleum-based materials. For instance, cellulose acetate fibers are increasingly being used in high-end and fast fashion apparel due to its breathable and lustrous properties.

Furthermore, Asia-Pacific, led by countries such as China, India, and Bangladesh, remians the primary hub for textile manufacturing and a key consumer of cellulose acetate fibers.

- According to Textile Exchange, global fiber production reached an all-time high of 124 million tonnes in 2023, representing a 7% increase from 116 million tonnes in 2022. This figure is projected to rise further, reaching approximately 160 million tonnes by 2030.

Market Challenge

"Volatility in Raw Material Prices"

A major challenge hindering the expansion of the cellulose acetate market is the fluctuation in raw material prices, particularly acetic acid and wood pulp. These price changes increase production costs and make it difficult for manufacturers to maintain stable pricing.

Consequently, end users face uncertainty in planning purchases, which can impact budgeting and supply chain decisions. This disrupts market predictability and complicates long-term planning for both producers and consumers.

To address this challenge, companies can secure long-term supply contracts to ensure stable pricing and availability of key raw materials. Additionally, they are investing in backward integrationto enhance supply chain control.

Diversifying suppliers helps reduce dependency on a single source. Some firms are exploring alternative raw materials to minimize risks. These strategies help improve cost stability and supply security.

Market Trend

"Rising Demand for Biodegradable Ingredients in Cosmetics"

The growing demand for sustainable materials is reshaping industries such as consumer goods, particulalry cosmetics. As concerns over micro plastic pollution intensify, manufacturers are increasingly turning to biodegradable, plant-based alternatives to replace traditional synthetic ingredients.

Acetate-based particles offer both performance and environmental benefits. This shift is fueling innovation as companies respond to regulatory pressures and consumer demand for eco-friendly products.

- In March 2025, Daicel Corporation launched the “BS7,” a new product in its BELLOCEA line of cellulose acetate spherical particles, designed to offer an environmentally friendly alternative to micro plastic beads in cosmetics. Made from acetic acid and plant-derived cellulose, BELLOCEA has been confirmed to biodegrade in soil, compost, and marine environments.

Cellulose Acetate Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Fiber, Plastics

|

|

By Application

|

Cigarette Filters, Textiles & Apparel, Photographic Films, Tapes & Labels, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Fiber and Plastics): The fiber segment earned USD 3.03 billion in 2023 due to the increasing demand for sustainable and biodegradable materials in various applications, including textiles and non-woven products.

- By Application (Cigarette Filters, Textiles & Apparel, Photographic Films, Tapes & Labels, and Others): The cigarette filters segment held a share of 26.15% in 2023, owing to the widespread use of cellulose acetate in filter production, supported by its cost-effectiveness and filtration efficiency.

Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America cellulose acetate market accounted for a share of around 34.09% in 2023, valued at USD 1.67 billion. This dominance is reinforced by the region’s strong demand for cellulose acetate in industries such as textiles, pharmaceuticals, and automotive.

Additionally, the presence of key market players and technological advancements are contributing to this notable expansion. With increasing awareness of sustainable and eco-friendly materials, the demand for cellulose acetate is expected to grow in the coming years.

Asia Pacific cellulose acetate industry is estimated to grow at a CAGR of 6.15% over the forecast period. This growth is fueled by the expanding textile industries in China and India, where cellulose acetate fibers are in high demand for garments and non-woven products.

The rising preference for sustainable, biodegradable materials in response to increasing environmental concerns is further boosting the adoption of cellulose acetate across various industries.

Furthermore, market players are supporting expansion by setting up new manufacturing facilities and increasing production capacity to meet the growing demand for cellulose acetate.

Regulatory Framework

- In the U.S., the Food and Drug Administration (FDA) regulates the use of cellulose acetate in applications such as food packaging and pharmaceuticals, ensuring it meets safety and quality standards.

- In China, the National Health Commission (NHC) oversees food contact materials, including cellulose acetate, under the Food Safety Law. Materials must be approved for use and comply with national standards to ensure food safety.

- In Europe, the European Chemicals Agency (ECHA) manages the registration, evaluation, authorization, and restriction of chemicals (REACH). It mandates registration for substances produced or imported in quantities of one tonne or more anually.

Competitive Landscape

The cellulose acetate industry features a moderately consolidated competitive landscape, with a mix of established multinational players and niche regional players. Key participants are increasingly adopting strategic realignments and operational consolidation.

By integrating various facilities into a unified framework, these companies aim to optimize supply chains, enhance production efficiency, and strengthen their global market footprint.

- In Nov 2023, IMCD India signed an agreement to acquire two business lines from CJ Shah and Company, covering Cellulose Acetate Butyrate, Coalescing Agents, Polyolefin Polymers, and other specialty chemicals primarily used in Paints, Coatings, Adhesives, and Lifesciences applications.

List of Key Companies in Cellulose Acetate Market:

- DAICEL CORPORATION

- Eastman Chemical Company

- Celanese Corporation

- Borregaard AS

- Rayonier Advanced Materials

- Rotuba, Inc.

- B. ENTERPRISES

- Grafix Plastics

- Haihang Industry

- Cerdia International GmbH

- Merck KGaA

- Sichuan Push Acetati Co.Ltd.

Recent Developments (Expansion)

- In March 2024, Celanese Corporation launched a new 70 kiloton vinyl acetate ethylene (VAE) unit at its Nanjing, China facility. This expansion enhances the company’s Acetyl Chain integration and increases its ability to meet growing regional demand for VAE and downstream redispersible polymer powders (RDP)

- In March 2024, Celanese Corporation commenced operations at its new 1.3-million-ton acetic acid plant in Clear Lake, which it claims to be the lowest-cost and lowest-carbon footprint facility globally. This expansion follows the company’s recently launched ISCC-certified carbon capture and utilization (CCU) project, which increased capacity at the Fairway Methanol joint venture with Mitsui & Co. Ltd. by 130 kilotons while capturing 180 kilotons of CO₂ industrial emissions.

- In September 2023, Gibaplast, a specialty compounder based in Italy, began using Eastman Tenite Renew in eyewear manufacturing. This sustainable material, an eco-friendly version of Tenite cellulose acetate propionate (CAP), incorporates over 20% certified recycled content into its biobased composition, maintaining the performance and quality of traditional Tenite CAP.